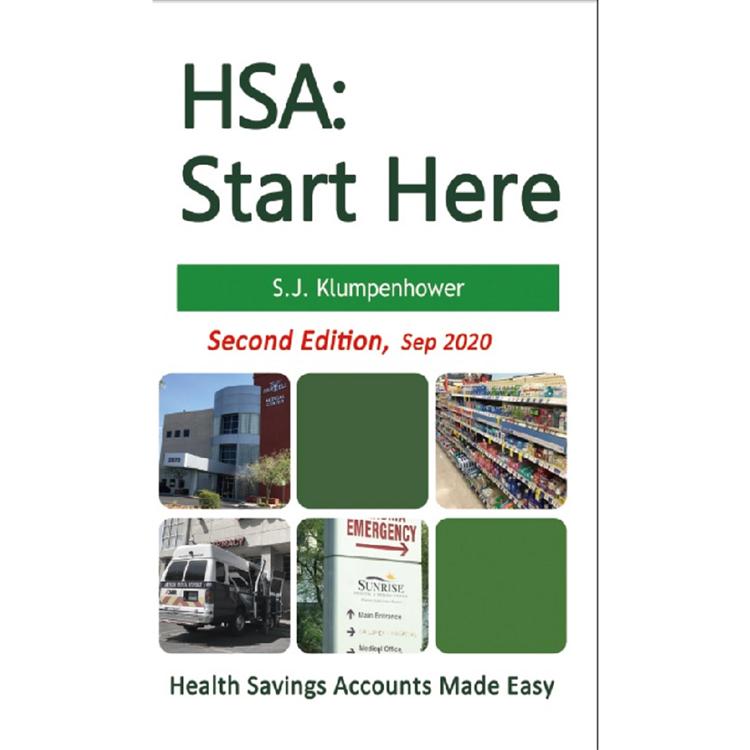

健康儲蓄戶口:由此開始(第二版國際英文版)

HSA: Start Here (Second Edition)

活動訊息

內容簡介

What is an HSA?

Health Savings Account – an account where you save money for your healthcare expenses. It is owned by a single person and maintained by an IRS-approved trust company or custodian.

A long life of health and financial security is an important goal for all Americans, but that’s often easier said than done. You likely know some steps that can improve your health and finances, like eating better, exercising more, and putting money into savings. But

did you know that switching your health plan can also help you save for the future? Switching plans can also help you to develop a pattern of better living so you can live a healthier life.

An alternative to a traditional healthcare plan is a Health Savings Account (HSA) matched with an eligible High-Deductible Health Plan (HDHP). This health plan is designed to give you more control over your health spending and help you save money for the future.

Health Savings Account – an account where you save money for your healthcare expenses. It is owned by a single person and maintained by an IRS-approved trust company or custodian.

A long life of health and financial security is an important goal for all Americans, but that’s often easier said than done. You likely know some steps that can improve your health and finances, like eating better, exercising more, and putting money into savings. But

did you know that switching your health plan can also help you save for the future? Switching plans can also help you to develop a pattern of better living so you can live a healthier life.

An alternative to a traditional healthcare plan is a Health Savings Account (HSA) matched with an eligible High-Deductible Health Plan (HDHP). This health plan is designed to give you more control over your health spending and help you save money for the future.

目錄

Table of Contents

◇Introduction: What is an HSA?

Why HSA?

Comparing Tax-Favored Accounts

How to Use this Book

◇Chapter 1: Eligibility

HSA-Eligible Health Plans

Other Coverage

Health FSAs and HRAs

◇Chapter 2: Contributions

Contribution Limits

Who Can Contribute

Comparability and Nondiscrimination

Owners and 2% or More Shareholders

Scheduling Contributions

Account Rollovers and Transfers

HSA-Rollover

IRA Transfer

Excess Contributions

◇Chapter 3: Distributions

Qualified Expenses

The Distribution Process

Save Receipts

Fees on Non-Eligible Withdrawals

◇Chapter 4: Account Management

Establishing Your HSA

Invest your Savings

Fund HSA First

Tips on Saving

Tax Reporting

◇Chapter 5: What about…?

Medicare

FMLA

Continuing Coverage

Losing and Regaining Eligibility

TRICARE and IHS Coverage

Divorce

Death

State Rules

◇Conclusion: Is HSA Right for You?

Taking Control of Your Health

Appendix I: Qualified Medical Expenses

Glossary

Resources

About the Author

◇Introduction: What is an HSA?

Why HSA?

Comparing Tax-Favored Accounts

How to Use this Book

◇Chapter 1: Eligibility

HSA-Eligible Health Plans

Other Coverage

Health FSAs and HRAs

◇Chapter 2: Contributions

Contribution Limits

Who Can Contribute

Comparability and Nondiscrimination

Owners and 2% or More Shareholders

Scheduling Contributions

Account Rollovers and Transfers

HSA-Rollover

IRA Transfer

Excess Contributions

◇Chapter 3: Distributions

Qualified Expenses

The Distribution Process

Save Receipts

Fees on Non-Eligible Withdrawals

◇Chapter 4: Account Management

Establishing Your HSA

Invest your Savings

Fund HSA First

Tips on Saving

Tax Reporting

◇Chapter 5: What about…?

Medicare

FMLA

Continuing Coverage

Losing and Regaining Eligibility

TRICARE and IHS Coverage

Divorce

Death

State Rules

◇Conclusion: Is HSA Right for You?

Taking Control of Your Health

Appendix I: Qualified Medical Expenses

Glossary

Resources

About the Author

序/導讀

How to Use this Book

This book is divided into chapters based on the different parts of owning an HSA, starting with determining eligibility and walking through how to make contributions, request distributions, and manage your account. The last chapter deals with specific scenarios that might affect you. In the back, you’ll find a list with some of the qualified medical expenses that you can use your HSA money for as well as a glossary of useful terms and resources for further research.

You can choose to read the book straight through, or you can skip to a particular chapter if you have questions about something specific. While the book is designed to build on itself as you go through, each section does stand alone and can be read separately. Feel free to take things at your own pace and reference items as needed.

This book is divided into chapters based on the different parts of owning an HSA, starting with determining eligibility and walking through how to make contributions, request distributions, and manage your account. The last chapter deals with specific scenarios that might affect you. In the back, you’ll find a list with some of the qualified medical expenses that you can use your HSA money for as well as a glossary of useful terms and resources for further research.

You can choose to read the book straight through, or you can skip to a particular chapter if you have questions about something specific. While the book is designed to build on itself as you go through, each section does stand alone and can be read separately. Feel free to take things at your own pace and reference items as needed.

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

不限金額免運費

-

海外

- 國際快遞:全球

-

港澳店取:

訂購/退換貨須知

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價