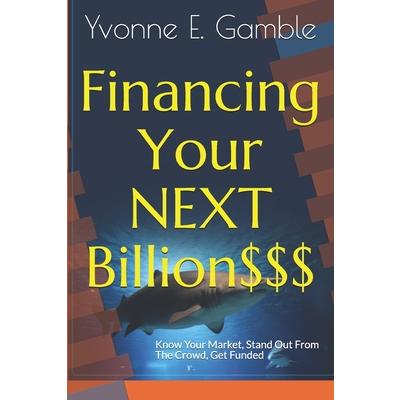

Financing Your NEXT Billion$$$

Financing Your NEXT Billion$$$Know Your Impact, Stand Out From The Cro

活動訊息

內容簡介

FINANCING OPTIONSWhile there are numerous financing options there is no one size fits all or most. Where your company currently stands financially and its business credibility will be determining factors in which options are available to you. We begin by taking an in-depth look at what it takes to do business with a Venture Capitalist (VC). CAPITAL RAISEVenture capital is the process of raising money from individuals and firms that invest in high growth, high risk companies. To compensate for higher risk, venture capital investors (VCs) expect a large return on their investment, higher than say a bank would expect. In addition, in exchange for their investment, VCs get partial ownership in your company, called equity, and some measure of control over decision-making.Raising venture capital is a tough endeavor and isn't right for all companies. But if you're considering this route for raising money, read on to learn the answers to the burning questions you have about why you are not attracting money. "Financing Your NEXT Billion$$$" will tell you everything you need to know about how to raise venture capital funding.DOES MY BUSINESS FIT THE VC MODEL?The first step in raising venture capital (VC) is making sure venture capital is right for your business. For many businesses and business owners it is not. Here are some questions you should ask yourself to assess if you're a good fit.ARE YOU WILLING TO LET GO OF SOME CONTROL OF YOUR BUSINESS?A lot of businesses owners underestimate the fact that raising venture capital means selling part of your company (i.e. equity) to sophisticated investors. Most business owners are used to being able to call all of the shots. Raising venture capital means being answerable to other people. You will need to have a plan that makes sense to your new partners. You will need to report monthly results to investors. And you will have to answer to others if you fall short of company goals. It's possible you may lose control of your company depending on how your capital raise is structured and how well you perform.WHAT DO I NEED TO PREPARE?Every business is a little bit different in what it will need to prepare for a VC round. Here's a general list that most companies will need to prepare for potential investors. You won't need all of these to start but you should have them ready before any potential investors start asking for them.Business PlanPresentation Pitch 10-20-30Product DemonstrationDetailed Product DocumentationReferencesEssentials in your 2-page Business PlanEach plan is different here are some common things you should probably cover in the detailed portion: Market opportunityWhy your solution is 10 times betterProof that you can sell and deliver your productGo-to-market planTeam, BoardScalabilityFinancials and projectionsKey risksThe order of these and any one item is less important than creating an overall convincing case that you've got a winner on your hands.DUE DILIGENCEMost business owners think of due diligence as a formality that a financier goes through just before closing the deal. That thought process is highly flawed. Due diligence begins the moment a VC is approached. While actual due diligence questions will vary depending on the type of business you have, here are some common areas. It's best to get prepared for all of this before engaging a VC. Financing Your NEXT Billion$$$ gives you a list of 26 Due Diligence items to get you on your way to investor compliance. To make the due diligence process go as smoothly as possible, do the following: Setup a Virtual Data Room. It's a good idea to keep a data room or a file sharing service (e.g. Dropbox), so investors can access and return to documents in an organized way.

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

不限金額免運費

-

海外

- 國際快遞:全球

-

港澳店取:

訂購/退換貨須知

加入金石堂 LINE 官方帳號『完成綁定』,隨時掌握出貨動態:

商品運送說明:

- 本公司所提供的產品配送區域範圍目前僅限台灣本島。注意!收件地址請勿為郵政信箱。

- 商品將由廠商透過貨運或是郵局寄送。消費者訂購之商品若無法送達,經電話或 E-mail無法聯繫逾三天者,本公司將取消該筆訂單,並且全額退款。

- 當廠商出貨後,您會收到E-mail出貨通知,您也可透過【訂單查詢】確認出貨情況。

- 產品顏色可能會因網頁呈現與拍攝關係產生色差,圖片僅供參考,商品依實際供貨樣式為準。

- 如果是大型商品(如:傢俱、床墊、家電、運動器材等)及需安裝商品,請依商品頁面說明為主。訂單完成收款確認後,出貨廠商將會和您聯繫確認相關配送等細節。

- 偏遠地區、樓層費及其它加價費用,皆由廠商於約定配送時一併告知,廠商將保留出貨與否的權利。

提醒您!!

金石堂及銀行均不會請您操作ATM! 如接獲電話要求您前往ATM提款機,請不要聽從指示,以免受騙上當!

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價