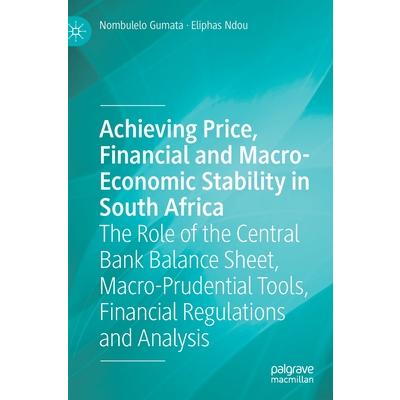

Achieving Price, Financial and Macro-Economic Stability in South Africa

Achieving Price, Financial and Macro-Economic Stability in South Afric

-

9折 6785元

7539元

-

預計最高可得金幣335點

?

可100%折抵

預計最高可得金幣335點

?

可100%折抵

活動加倍另計 -

HAPPY GO享100累1點 4點抵1元 折抵無上限

-

分類:英文書>財經企管>經濟/金融追蹤? 追蹤分類後,您會在第一時間收到分類新品通知。

- 作者: Nombulelo,Gumata 追蹤 ? 追蹤作者後,您會在第一時間收到作者新書通知。

- 出版社: Palgrave M 追蹤 ? 追蹤出版社後,您會在第一時間收到出版社新書通知。

- 出版日:2021/05/30

內容簡介

1. Introduction.- 2. Do capital inflows relieve banks' credit constraints and boost credit growth? Evidence from credit conditions and bank credit risk.- 3. Credit conditions and the amplification of macroeconomic responses to unexpected shocks: Implications for monetary policy.- 4. Output and inflation responses to single and double credit threshold effects in South Africa.- 5. Do contractionary fiscal shocks transmitted via GDP growth dampen credit growth?.- 6. Do synchronised credit and house price booms impact the monetary policy reaction to inflationary pressures?.- 7. Do synchronised boom and non-boom episodes in credit, commodity and equity prices impact the response of the repo rate to positive inflation shocks?.- 8. To what extent do capital inflows impact response of South African economic growth to positive SA-US interest rate differential shocks?.- 9. Is there a compelling case to increase the SARB holdings of government securities to supplement interest income and neutralize loses due foreign investments and foreign currency reserves accumulation?.- 10. Are the amplification effects of positive shocks to SARB assets and forex reserves on long-term yields dependent on government debt regimes?.- 11. Foreign Currency Reserves: Do they contribute to GDP and employment growth?.- 12. What is the impact of large-scale asset purchases and banks' balance sheets?.- 13. Is the interest rate corridor an effective instrument to dampen the accumulation of excess reserves and inter-bank rate volatility?.- 14. Is the impact of the unexpected positive required reserves ratio shock on inflation expectations different to that due to positive excess LAH and forex reserves shock?.- 15. How potent is the required reserves impact tightening shock on funding and consumer interest rates?.- 16. The impact of large-scale asset purchases on non-resident purchases of South African assets.- 17. Large scale asset purchases and activity in the primary and secondary share and bond markets.- 18. The stock and flow effects of large-scale asset purchases: Evidence from persistent vs transitory shocks.- 19. Has the inflation target band impacted the natural rate of unemployment in South Africa? Evidence from the accelerationist Philips curve.- 20. Do regulatory tools impact the transmission of capital inflow shocks into credit extension and induce the reallocation of sectoral credit shares?.- 21. What role do non-performing loans play in propagating the excess LAH shock effects on sectoral credit re-allocation?.- 22. Is excess CAR beneficial in neutralising excessive credit growth and inflationary pressures? What are the implications for monetary and financial policy?.- 23. Do non-performing loans propagate the transmission of monetary policy tightening shocks to sectorial credit?.- 24. How effective is the relaxation of the countercyclical capital buffer at a time when other residential macro-prudential tools are tight?.- 25. Revisiting the role of money demand function: Does the short fall in money demand impact the inflation responses of rand depreciation shocks?.- 26. Do the shortfalls and overhangs derived from money demand in South Africa augmented with portfolio balances impact inflation dynamics?.- 27. Do the exchange rate depreciation and volatility shocks impact money demand in South Africa?.- 28. Does economic policy uncertainty impact real money demand in South Africa?.- 29. Is a single sectorial credit growth threshold too restrictive? Evidence from the output and inflation.- 30. Does the threshold for household debt growth matter for GDP growth and response of monetary policy to inflation shocks?.- 31. How does a positive repo rate shock affect the household sector intermediation? Evidence from households' flow-of-funds data.- 32. To what extent are the public and private's sector financial asset flows impacted by monetary policy tightening shock?.

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

-

海外

- 國際快遞:全球

訂購/退換貨須知

加入金石堂 LINE 官方帳號『完成綁定』,隨時掌握出貨動態:

商品運送說明:

- 本公司所提供的產品配送區域範圍目前僅限台灣本島。注意!收件地址請勿為郵政信箱。

- 商品將由廠商透過貨運或是郵局寄送。消費者訂購之商品若無法送達,經電話或 E-mail無法聯繫逾三天者,本公司將取消該筆訂單,並且全額退款。

- 當廠商出貨後,您會收到E-mail出貨通知,您也可透過【訂單查詢】確認出貨情況。

- 產品顏色可能會因網頁呈現與拍攝關係產生色差,圖片僅供參考,商品依實際供貨樣式為準。

- 如果是大型商品(如:傢俱、床墊、家電、運動器材等)及需安裝商品,請依商品頁面說明為主。訂單完成收款確認後,出貨廠商將會和您聯繫確認相關配送等細節。

- 偏遠地區、樓層費及其它加價費用,皆由廠商於約定配送時一併告知,廠商將保留出貨與否的權利。

提醒您!!

金石堂及銀行均不會請您操作ATM! 如接獲電話要求您前往ATM提款機,請不要聽從指示,以免受騙上當!

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價