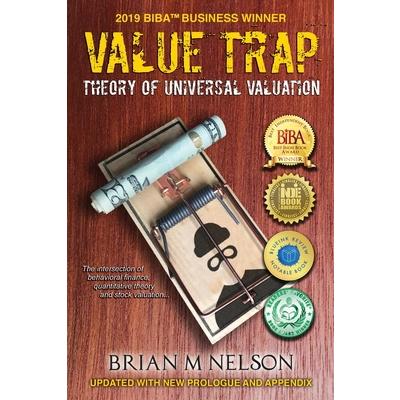

Value TrapTheory of Universal Valuation

Value TrapTheory of Universal Valuation

內容簡介

WOODSTOCK, Ill., March 24, 2021 /PRNewswire/ -- The second edition of the business book Value Trap: Theory of Universal Valuation has been awarded the bronze medal in the category of Personal Finance/Retirement Planning/Investing at the 2021 Axiom Business Book Awards, presented by Jenkins Group. Less than 20% of this year's entries won an award, and medals went to a mix of the established Big 5 publishers, prestigious university presses, and independent publishers. Previous Axiom Business Book Award medalists include Nobel laureate Robert Shiller, former U.S. Secretary of State Condoleezza Rice, and world-renowned historian and Pulitzer Prize winner Doris Kearns Goodwin. "It's an honor to be in the company of such esteemed publishers and exemplary authors," said Valuentum's President Brian Nelson, CFA. "Thank you to everyone at Jenkins Group for having such a fine awards program, and my deepest congratulations to all of this year's winners." Nelson's book Value Trap continues to advance finance and investing, encouraging forward-looking analysis in quantitative data applications while warning about price-agnostic trading and its impact on the health of the stock market and the savings of everyday investors. BookLife by Publishers Weekly noted of Value Trap that "readers steeped in the stock market will appreciate this persuasive economic treatise, which sounds the alarm on spurious quantitative analysis." BlueInk Review said the book "stands on its considerable merits as a well written and cogent articulation of a distinct perspective on equity analysis." Review: "Data 'makes us feel like we are in control, but the conclusions can be misleading if the data isn't used in the right way, ' Nelson warns in his persuasive debut, which attempts to shift the market's belief in quantitative models of stock analysis back toward a more traditional enterprise valuation approach. Nelson, the president of equity and dividend growth research at Valuentum Securities, demonstrates how quantitative evaluative techniques that base pricing and investment strategies on trends in large sets of past data can lead investors to mistake correlation for causation. This can lead to conclusions that, as he puts it, are 'no more predictive than believing the divorce rate in Maine will fall if we just slow our margarine consumption' simply because those two statistics have risen and fallen together. Nelson makes the case that 'spurious' or statistically insignificant correlations mined from ambiguous past data aren't just a danger for individual investors or investment managers, but in an era of unprecedented volatility, these strategies will continue to increase the market's erratic tendencies (especially in the uncertain age of Covid-19). Nelson proposes instead that greater returns-and greater market stability-would come from resuming strategies based on enterprise valuation, with an emphasis on forward-looking causal data and companies' available cash assets. This second edition is updated with a hefty prologue that invites readers to evaluate Nelson's track record. He surveys the relative stability of his Valuentum stocks-stocks that meet the criteria of his 15-point checklist-over the course of 2020, demonstrating them to have been at least "pandemic-resistant" when not "pandemic-proof." Readers eager for a simple investing system may find Nelson's thorough case-making frustrating, but this work was conceived as a cry for economic stability, not an entry-level guide, and more experienced investors will find it thought-provoking and worth their time. Takeaway: Readers steeped in the stock market will appreciate this persuasive economic treatise, which sounds the alarm on spurious quantitative analysis. Great for fans of Aswath Damodaran's 'The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit'; Richard Barker's 'Determining Value: Valuation Models and Financial Statements.'" -- BookLife Review by Publish

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

不限金額免運費

-

海外

- 國際快遞:全球

-

港澳店取:

訂購/退換貨須知

加入金石堂 LINE 官方帳號『完成綁定』,隨時掌握出貨動態:

商品運送說明:

- 本公司所提供的產品配送區域範圍目前僅限台灣本島。注意!收件地址請勿為郵政信箱。

- 商品將由廠商透過貨運或是郵局寄送。消費者訂購之商品若無法送達,經電話或 E-mail無法聯繫逾三天者,本公司將取消該筆訂單,並且全額退款。

- 當廠商出貨後,您會收到E-mail出貨通知,您也可透過【訂單查詢】確認出貨情況。

- 產品顏色可能會因網頁呈現與拍攝關係產生色差,圖片僅供參考,商品依實際供貨樣式為準。

- 如果是大型商品(如:傢俱、床墊、家電、運動器材等)及需安裝商品,請依商品頁面說明為主。訂單完成收款確認後,出貨廠商將會和您聯繫確認相關配送等細節。

- 偏遠地區、樓層費及其它加價費用,皆由廠商於約定配送時一併告知,廠商將保留出貨與否的權利。

提醒您!!

金石堂及銀行均不會請您操作ATM! 如接獲電話要求您前往ATM提款機,請不要聽從指示,以免受騙上當!

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價