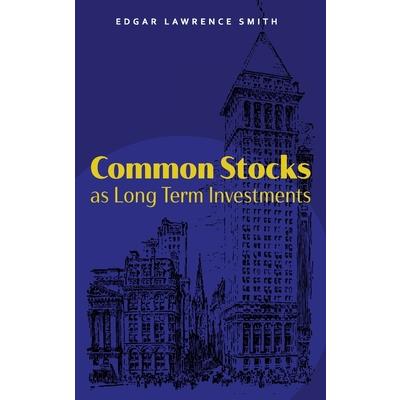

Common Stocks as Long Term Investments

-

9折 819元

910元

-

預計最高可得金幣40點

?

可100%折抵

預計最高可得金幣40點

?

可100%折抵

活動加倍另計 -

HAPPY GO享100累1點 4點抵1元 折抵無上限

-

分類:英文書>文學>世界文學追蹤? 追蹤分類後,您會在第一時間收到分類新品通知。

- 作者: Edgar Lawrence,Smith 追蹤 ? 追蹤作者後,您會在第一時間收到作者新書通知。

- 出版社: Mockingbird Press 追蹤 ? 追蹤出版社後,您會在第一時間收到出版社新書通知。

- 出版日:2022/08/21

內容簡介

Common Stocks as Long Term Investments (1924) by Edgar Lawrence Smith proved for the first time that stocks outperformed bonds in long-term stock market investments. Before Smith's work, the prevailing wisdom regarding investing stated that bonds were a safer investment. Conservative investors would allocate a large portion of their investments to bonds, relying on the annual rate of interest as a sure bet. Stocks, on the other hand, were viewed as risky speculations, due to the market's volatility.

Smith himself held that view, before beginning the research for this book. As he told his Harvard class at their 50th reunion, "I tried to write a pamphlet on why bonds were the best form of long term investment. But supporting evidence for this thesis could not be found."

Edgar Lawrence Smith (b. 1882, d. 1971) was a Harvard-educated economist and investment manager. While working as an advisor to the brokerage firm Low, Dixon & Company, he began to look at the relative performance of bonds versus stocks.

Through 11 case studies completed for Common Stocks as Long Term Investments, Smith proved that the prevailing wisdom in favor of bonds over stocks was wrong. In 10 out of the 11 cases, a $10,000 investment in arbitrarily chosen stocks would have outperformed an equal investment in high-grade bonds. And in the 11th case, the lower return was impacted by two market panics and inflation (in the years 1866-1885).

How does Smith account for the better performance of stocks over time? To begin, stocks often grow with or even in excess of inflation. Returns on bonds, on the other hand, lose purchasing power over time due to inflation. In addition, the general march of progress through population growth and improved standards of living over time leads to greater demand for products and services. The trajectory of progress often leads to growth that outpaces inflation, making stocks a better long-term investment.

Smith's work supports a long-term investment strategy. He shows that over 15 years, the value of stocks sees a loss only 1.1% of the time. While they may be subject to short-term fluctuations, their long-term reliability makes them a smart investment as part of a balanced portfolio. Smith does not advocate against bonds. He merely suggests that investors give heavier weight to stocks than bonds, rather than the other way around.

Famous economists Irving Fisher and John Maynard Keynes praised the book. Keynes invited Smith to join the Royal Economic Society, and Fisher directly stated that he had more confidence in common stocks due to Smith's work. Unfortunately, Smith, Irving, Keynes, and the rest of the world were about to discover that while stocks were generally the best long-term investments, there could still be ruinous market fluctuations.

The Wall Street Crash of 1929 was the ruin of many individuals and businesses. Keynes' fortune was nearly wiped out. Irving lost over $100M in today's dollars. And Smith himself had to sell his own mutual fund firm, Investment Managers Company. In the subsequent years, Smith focused instead on research and writing, rather than working directly in the financial industry.

But the long-term reliability of common stocks still holds. Even accounting for large market downturns, a diversified investment portfolio weighted to common stocks is still the clear financial winner when we look at an investment strategy over decades.

While Smith suffered from the Crash of '29 (along with the rest of the country, including great economists), his ideas have been backed up since he first published, by Alfred Cowles in 1939 and again by Rex Sinquefield in 1976.

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

不限金額免運費

-

海外

- 國際快遞:全球

-

港澳店取:

訂購/退換貨須知

加入金石堂 LINE 官方帳號『完成綁定』,隨時掌握出貨動態:

商品運送說明:

- 本公司所提供的產品配送區域範圍目前僅限台灣本島。注意!收件地址請勿為郵政信箱。

- 商品將由廠商透過貨運或是郵局寄送。消費者訂購之商品若無法送達,經電話或 E-mail無法聯繫逾三天者,本公司將取消該筆訂單,並且全額退款。

- 當廠商出貨後,您會收到E-mail出貨通知,您也可透過【訂單查詢】確認出貨情況。

- 產品顏色可能會因網頁呈現與拍攝關係產生色差,圖片僅供參考,商品依實際供貨樣式為準。

- 如果是大型商品(如:傢俱、床墊、家電、運動器材等)及需安裝商品,請依商品頁面說明為主。訂單完成收款確認後,出貨廠商將會和您聯繫確認相關配送等細節。

- 偏遠地區、樓層費及其它加價費用,皆由廠商於約定配送時一併告知,廠商將保留出貨與否的權利。

提醒您!!

金石堂及銀行均不會請您操作ATM! 如接獲電話要求您前往ATM提款機,請不要聽從指示,以免受騙上當!

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價