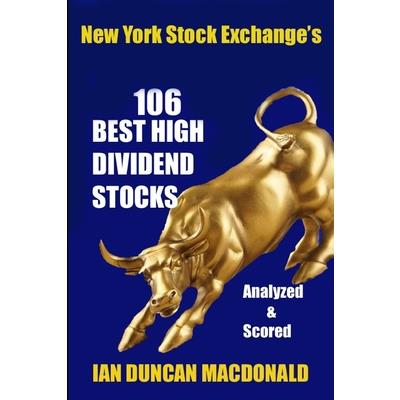

New York Stock Exchange’s 106 Best High Dividend Stocks

New York Stock Exchange's 106 Best High Dividend Stocks

-

9折 635元

705元

-

預計最高可得金幣30點

?

可100%折抵

預計最高可得金幣30點

?

可100%折抵

活動加倍另計 -

HAPPY GO享100累1點 4點抵1元 折抵無上限

-

分類:英文書>財經企管>投資理財追蹤? 追蹤分類後,您會在第一時間收到分類新品通知。

- 作者: Ian Duncan,MacDonald 追蹤 ? 追蹤作者後,您會在第一時間收到作者新書通知。

- 出版社: Informus Inc 追蹤 ? 追蹤出版社後,您會在第一時間收到出版社新書通知。

- 出版日:2023/01/23

內容簡介

NO ONE CARES AS MUCH ABOUT YOUR MONEY AS YOU DO!To build a strong, safe, stock portfolio that will grow for the rest of your life and provide you with a generous monthly income, there is no need to entrust your life savings to an investment advisor. The 2% to 4% in advisor fees, charges and commissions will drain hundreds of thousands of dollars from your portfolio whether that portfolio grows or not. The secret of building a strong, generous portfolio is to keep it simple. This means investing equally in 20 financially strong companies paying high dividends with long histories of share price increases and increasing dividend payouts. Dividends are the quickest way to identify potentially strong companies. Scoring such stocks allows you to sort them from most to least desirable. Although readers are shown how to score stocks manually, the stock scoring software that is used throughout the book is provided on request, to those purchasing the book to make scoring even easier and faster. To further assist you, the book has identified, scored and analyzed the best 106 dividend stocks out of the 2,788 stocks traded on the New York Stock Exchange. In a 2 page analysis of each stock, at a glance, you can compare each stock's strength: average volumes traded, operating margins, book values, dividend yield percent, price-to-earnings and of course their composite scores. Share prices and dividend payouts are supplied for each year back to 1999. You can easily see how these strong companies were minimally impacted by the stock market crashes of 2000, 2008 and 2020. Many continued to increase their dividend payouts through these crashes. While it is impossible to accurately predict future share prices, it is far easier to predict future dividend payouts. Fluctuating share prices that are a result of competitive bidding between positive speculators and negative speculators reacting to media hype, rumors and investment promotions. Dividends are derived from profits. Profits are the result of the wise revenue and expense decisions made by company executives. While profits can influence speculators. Speculators do not control profits. The book shows you how to choose the best 20 stocks whose dividends can average a return of 6% and, in most years, grow the portfolio's capital value by 12% or more. If you invest your annual dividend income you can expect to double the value of your portfolio within five years. Each of Ian's books have been an evolution in making it easier for both investors unfamiliar with investing to achieve safe financial independence and for experienced investors to quickly choose strong dividend stocks for their existing portfolios. The following is extracted from this latest book's Index Page: Chapter 1 Building a Strong Stock Portfolio page 17

Chapter 2 How to Find Exceptional Stocks page 32

Chapter 3 The Eleven Data Scoring Elements page 39

Chapter 4 The Stock Scoring Formula page 52

Chapter 5 Stock Choice Balancing Chart page 69

Chapter 6 Alpha Sort of the 106 Stocks page 72

Chapter 7 Dividend % Sort of the 106 Stocks page 78

Chapter 8 Stock Score Sort of the 106 Stocks page 83

Chapter 9 106 High Dividend Stocks Analyzed page 89

Chapter 10 Expenses Are Very Important page 303

Chapter 11 The Final Words page 315

Chapter 2 How to Find Exceptional Stocks page 32

Chapter 3 The Eleven Data Scoring Elements page 39

Chapter 4 The Stock Scoring Formula page 52

Chapter 5 Stock Choice Balancing Chart page 69

Chapter 6 Alpha Sort of the 106 Stocks page 72

Chapter 7 Dividend % Sort of the 106 Stocks page 78

Chapter 8 Stock Score Sort of the 106 Stocks page 83

Chapter 9 106 High Dividend Stocks Analyzed page 89

Chapter 10 Expenses Are Very Important page 303

Chapter 11 The Final Words page 315

配送方式

-

台灣

- 國內宅配:本島、離島

-

到店取貨:

不限金額免運費

-

海外

- 國際快遞:全球

-

港澳店取:

訂購/退換貨須知

加入金石堂 LINE 官方帳號『完成綁定』,隨時掌握出貨動態:

商品運送說明:

- 本公司所提供的產品配送區域範圍目前僅限台灣本島。注意!收件地址請勿為郵政信箱。

- 商品將由廠商透過貨運或是郵局寄送。消費者訂購之商品若無法送達,經電話或 E-mail無法聯繫逾三天者,本公司將取消該筆訂單,並且全額退款。

- 當廠商出貨後,您會收到E-mail出貨通知,您也可透過【訂單查詢】確認出貨情況。

- 產品顏色可能會因網頁呈現與拍攝關係產生色差,圖片僅供參考,商品依實際供貨樣式為準。

- 如果是大型商品(如:傢俱、床墊、家電、運動器材等)及需安裝商品,請依商品頁面說明為主。訂單完成收款確認後,出貨廠商將會和您聯繫確認相關配送等細節。

- 偏遠地區、樓層費及其它加價費用,皆由廠商於約定配送時一併告知,廠商將保留出貨與否的權利。

提醒您!!

金石堂及銀行均不會請您操作ATM! 如接獲電話要求您前往ATM提款機,請不要聽從指示,以免受騙上當!

退換貨須知:

**提醒您,鑑賞期不等於試用期,退回商品須為全新狀態**

-

依據「消費者保護法」第19條及行政院消費者保護處公告之「通訊交易解除權合理例外情事適用準則」,以下商品購買後,除商品本身有瑕疵外,將不提供7天的猶豫期:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮食品)

- 依消費者要求所為之客製化給付。(客製化商品)

- 報紙、期刊或雜誌。(含MOOK、外文雜誌)

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書、電子雜誌、下載版軟體、虛擬商品…等)

- 已拆封之個人衛生用品。(如:內衣褲、刮鬍刀、除毛刀…等)

- 若非上列種類商品,均享有到貨7天的猶豫期(含例假日)。

- 辦理退換貨時,商品(組合商品恕無法接受單獨退貨)必須是您收到商品時的原始狀態(包含商品本體、配件、贈品、保證書、所有附隨資料文件及原廠內外包裝…等),請勿直接使用原廠包裝寄送,或於原廠包裝上黏貼紙張或書寫文字。

- 退回商品若無法回復原狀,將請您負擔回復原狀所需費用,嚴重時將影響您的退貨權益。

商品評價