Surrounded by Idiots

Do you ever think you're the only one making any sense? Or tried to reason with your partner with disastrous results? Do long, rambling answers drive you crazy? Or does your colleague's abrasive manner rub you the wrong way? You are not alone. After a disastrous meeting with a highly successful entrepreneur, who was genuinely convinced he was 'surrounded by idiots', communication expert and bestselling author, Thomas Erikson dedicated himself to understanding how people function and why we often struggle to connect with certain types of people. Surrounded by Idiots is an international phenomenon, selling over 1.5 million copies worldwide. It offers a simple, yet ground-breaking method for assessing the personalities of people we communicate with - in and out of the office - based on four personality types (Red, Blue, Green and Yellow), and provides insights into how we can adjust the way we speak and share information. Erikson will help you understand yourself better, hone communication and social skills, handle conflict with confidence, improve dynamics with your boss and team, and get the best out of the people you deal with and manage. He also shares simple tricks on body language, improving written communication, advice on when to back away or when to push on, and when to speak up or shut up. Packed with 'aha!' and 'oh no!' moments, Surrounded by Idiots will help you understand and communicate with those around you, even people you currently think are beyond all comprehension. And with a bit of luck you can also be confident that the idiot out there isn't you!

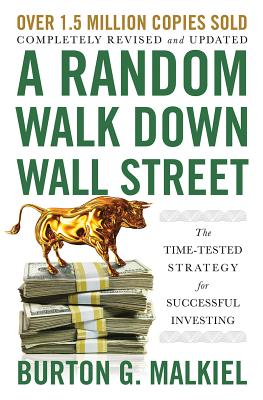

A Random Walk Down Wall Street

In a time of increasing inequality, when high-frequency traders and hedge-fund managers seem to tower over the average investor, Burton G. Malkiel's classic and gimmick-free investment guide is now more necessary than ever. Rather than tricks, what you'll find here is a time-tested and thoroughly research-based strategy for your portfolio. Whether you're considering your first 401k contribution or contemplating retirement, this fully-updated edition of A Random Walk Down Wall Street should be the first book on your reading list.In A Random Walk Down Wall Street you'll learn the basic terminology of "the Street" and how to navigate it with the help of a user-friendly, long-range investment strategy that really works. Drawing on his own varied experience as an economist, financial adviser, and successful investor, Malkiel shows why an individual who buys over time and holds a low-cost, internationally diversified index of securities is still likely to exceed the performance of portfolios carefully picked by professionals using sophisticated analytical techniques. In this new edition, Malkiel provides a brand-new section on the recent bubble in cryptocurrencies like Bitcoin, as well as valuable new material on "tax-loss harvesting"--the crown jewel of tax management. He also presents a critical analysis of two recently popular investment-management techniques: factor investing and risk parity.On top of all this, the book's classic lifecycle guide to investing, which tailors strategies to investors of any age, will help you plan confidently for the future. You'll learn how to analyze the potential returns, not only for basic stocks and bonds but for the full range of investment opportunities--from money market accounts and real estate investment trusts to insurance, home ownership, and tangible assets like gold and collectibles. Individual investors of every level of experience and risk tolerance will find throughout the book the critical facts and step-by-step guidance they need to protect and grow their hard-earned dollars.

Wealth Is Simple to Elevate

If you work hard, earn decent money, and still wonder where it all goes each month, this isn't a discipline problem. It's a systems problem.This book gives you a proven, step-by-step framework to reduce money stress, regain control of your cash, and build wealth sustainably without extreme budgeting or constant sacrifice.Written by Dr. Maria James, a trained scientist turned financial wellness strategist, this book applies the same analytical thinking, evidence-based methods, and behavior-change principles used in science to personal finance. The result? A system that actually works with how humans earn, spend, and make money decisions.Inside, you'll learn how to: Design a cash-flow system that adapts to irregular or fluctuating incomeBreak the paycheck-to-paycheck cycle using data-driven spending decisions, not guilt.Reduce debt faster while protecting your energy, mental health, and lifestyle.Align money with what matters most: travel, family, freedom, and future goals.Use modern tools, automation, and apps to simplify money management.Build long-term wealth through ethical, sustainable investment strategies.Plan confidently for homeownership, children's education, retirement, and legacy wealth.This book is for ambitious adults who are doing "everything right" on paper yet still feel financially tense, overwhelmed, or behind. If you want clarity instead of chaos and confidence instead of constant second-guessing, this system was built for you.No fluff. No shame. No financial guesswork.

Create Your EPIC Executive Brand

Illuminate Your EPIC Executive Brand and Supercharge Your Career!Why leave your professional reputation to chance when you can design an intentional executive brand that sets you apart and propels you, your organization, and others forward?Step confidently into the spotlight with Create Your EPIC Executive Brand, a transformative workbook designed for leaders and executives who aspire to Elevate their professional Presence, Influence, and Connectivity. Whether you are a seasoned executive seeking a fresh edge or an ambitious leader ready to rise, this workbook by Carol Bergeron delivers a proven, four-phase process to help you clarify your unique talents, strengths, and aspirations, communicate your executive brand, craft a compelling narrative adaptable for any occasion, and consistently show up as your true self in daily life.What sets this workbook apart is its simplicity in fostering deep reflection and actionable outcomes. The four-phase journey includes: Clarifying Who You Are Now: Revisit your life's story and core values. Surface your mix of superpowers, talents, and leadership qualities through your own lens as well as the lens of others.Declaring Your Aspirations: Set bold leadership goals and define the positive feelings and experiences you want others to have when routinely engaging with you. Crafting Your Narrative: Shape your unique executive brand that adapts seamlessly to any occasion from introductions at industry conferences, the pursuit of bigger leadership roles, and delivery of keynote speaking engagements to your social media biography descriptors.Action Planning: Develop a plan that makes your authentic brand a reality in daily interactions, transforms strengths into superpowers, cultivates rich relationships in your organization and industry, and contributes to your brand and visibility as well as your organization.By completing this journey, you'll better understand yourself and build a strong foundation for confidently leading teams that drive profound results, presenting your value in high-stakes forums, cultivating influential networks, contributing to your organization's brand, amplifying your professional presence within your organization and across your industry, and achieving new heights in your career and leadership legacy.More than a guide, Create Your EPIC Executive Brand is a catalyst for personal and professional transformation. With clear instructions for reflections, inspiring examples, and a focus on actionable results, it is the essential resource for any busy leader ready to Elevate their Presence, Influence, and Connectivity to supercharge their career.Invite a trusted colleague or small group of peers to join you on this journey, giving you the opportunity to test and refine your authentic brand in a supportive, collaborative environment allowing you to gather valuable feedback before sharing it more broadly. Carol Bergeron's acclaimed publications - Create Your EPIC Executive Brand, People Succession: Lessons from Forward Thinking Executives in Middle-Market Companies, and Take the Retirement Life Design Challenge - empower career achievers to navigate pivotal transitions with confidence. Each title delivers actionable strategies and inspiration for professionals who aspire to elevate their impact, lead boldly, and shape a lasting legacy.

The Strategic Money Method

Money Confidence Starts with the Right MindsetFinancial success isn't about mastering complex formulas or memorizing rigid rules. You don't need to know everything about money to build a secure future. If you've ever felt overwhelmed or unsure where to start, ask yourself: What do I want my money to do for me? The answer is the vision for your financial strategy, guided by your everyday decisions, mindsets, and habits.Patrick Payne, professor of financial planning, shares a refreshingly accessible approach to money. Blending behavioral insights with financial principles, Payne helps you uncover your unique money personality and build a focused strategy based on what matters most to you, without feeling deprived or defeated. Learn how to spend with purpose, use debt wisely, and invest with clarity.Explore relatable stories and practical tools designed to meet you where you are. You don't need to be a financial expert to take control of your future. Whether you're just starting out or starting over, you'll walk away with a clear path forward and the confidence to take it.

Crush Your Next Virtual Presentation

Virtual presenting isn't the future-it's the new normal. Whether you lead meetings, teach classes, or pitch ideas, your audience now meets you on a screen. Crush Your Next Virtual Presentation shows you how to show up for your audience with presence, clarity, and impact--no studio, big budget, or tech wizardry required.Presentation expert Rick Altman draws from decades of training speakers and from hosting the celebrated Presentation Summit User Conference to help you master the four essentials: visual storytelling, authentic connection, confident delivery, and smart use of technology.You'll learn to design slides that resonate, use your voice and body naturally, create a professional on-camera look, and harness AI and other tools without losing the human touch.Every chapter links to exclusive video demos, instantly accessible by QR code, so you can watch techniques come alive and put them to work right away.Practical, witty, and packed with field-tested tips, this guide turns any virtual talk into an experience that informs, inspires, and elevates.

The Master Money Maker

What if money came with a clear, no-nonsense manual...one that spoke to real life, real challenges, and real people? In a world where bills clash with dreams and society often underestimates your potential, The Master Money Maker (M3) empowers you to reclaim control of your financial future. Blending time-honored principles with modern tools, this guide delivers practical, approachable steps grounded in Christian money management and focused on true transformation.Authors Joseph and Rhonda Frazier unite the strategic precision of engineers with 35 years of lived experience in entrepreneurship. Joe presents the proven systems behind wealth creation: the M3 Science. Rhonda reveals the M3 Art and Mindset, offering insights for profound money mindset transformation and purpose-driven living.Whether you're a young adult, a family seeking financial literacy for families, a small business owner, or a gig worker striving for stability, this book meets you where you are. Unlike typical financial guides, M3 tackles life's "grey areas" tax issues, divorce, caregiving, and unexpected setbacks, making it a true financial crisis survival guide.Through the powerful M.A.K.E.R. framework, you'll learn: - How to take charge of your money with a practical budgeting and spending plan.- Smart asset-building and wealth building for Christians.- Strategies to protect your income and future.- How to embrace opportunity through entrepreneurship for beginners.- Proven debt-free living strategies, including the Debt Snowball method.- Clear personal finance for beginners guidance that anyone can follow.Stop guessing. Start building. Transform your finances and your life with The Master Money Maker. Dare to believe in your potential and step confidently into a future of purpose, stability, and impact.

The Next Perfect Trade

In the battle of investment, you have to be prepared. Investing is an intellectual battle, one requiring thoughtful strategy. You must develop a plan. Get in shape. Procure your armor, helmet, and shield so you're prepared for the market's first arrow. The Next Perfect Trade shifts focus from the forces that drive markets to those that drive successful trades, an approach HonTe Investments founder Alex Gurevich named the "Magic Sword of Necessity." With complete training and equipment, the sword of necessity gives you a devastating advantage. In this second edition, Alex returns ten years later to review his predictions and provide new content, highlighting the successes--and failures--of his strategy. He presents criteria for superior trades that can be profitable in the broadest range of economic scenarios, every chapter leading you a step closer to mastery. For aspiring and experienced investors, this second edition of The Next Perfect Trade is a practical guide for elevating your position in the world of investment.

Stand Out From The Rest

Wherever we are heading in this world, there's a growing need for us to seize our opportunities and make the most of the 'big moments' in life. The employment market is becoming more competitive, so a job interview is precisely a 'big moment' where we must ensure we present the best version of ourselves. This guide introduces a unique approach called the 4-Box Method. This method begins by teaching you how to adopt a fresh perspective for the initial preparation phase before the interview, which then evolves into a technique called the Key, which you will use on the interview day. When used effectively, the Key will help you to unlock your interview and allow you to positively influence the flow of conversation on your terms. The method is intended to help you differentiate your interview application and stand out from your competitors, ensuring that you execute your best performance during the interview and leave a lasting impression long after you have departed the room.

Braving the Workplace

Dr. Beth Kaplan offers a lifeline for personal and professional fulfillment with Braving the Workplace!Practical steps for transformation. Dr. Beth Kaplan shares her expertise on belonging in the workplace while sharing insights on this vital element in a rapidly changing corporate landscape. Braving the Workplace combines groundbreaking research with engaging storytelling to offer a comprehensive guide for businesses. Dr. Kaplan provides a clear, actionable framework to help organizations cultivate a sense of belonging among their employees while promoting mental health.Belonging and the workplace. This book is valuable for many readers, from individuals grappling with personal belonging issues to senior leaders tackling leadership challenges and driving inclusivity. It provides strategies to effectively assume leadership roles, create a diverse work environment, and boost employee productivity. Braving the Workplace is a must-read for making belonging a fundamental aspect of any organization.Inside, you will find: A step-by-step guide on how to take action and create change for a diverse work environmentStrategies for personal growth in finding a sense of belonging in the workplaceTechniques for having inclusive conversations to foster a positive work environmentIf you enjoy books on work culture, such as Belonging, Inclusion on Purpose, or You Belong Here, then Braving the Workplace is for you!

Beyond Billionaires

What if the real future of prosperity isn't locked in boardrooms or billionaire fortunes, but in the everyday systems we build together? Around the world, a quiet revolution is reshaping the economy-from neighborhood credit unions to global B-Corps-proving that wealth can be designed to circulate, not concentrate. This book reveals why the next wave of capitalism is being forged not by titans of industry but by communities, cooperatives, and purpose-driven firms rewriting the rules of ownership. In an age where corporate governance often rewards extraction over fairness, models of stakeholder capitalism and shared ownership show a different path-one that balances profit with resilience, equity, and trust. Through compelling case studies of community banks and credit unions, thriving cooperative business models, and innovative platform cooperatives, readers will see how alternative systems already outperform conventional enterprises in durability and social impact. This book is written for entrepreneurs, leaders, policymakers, and citizens who sense that the current system is reaching its limits-and are searching for credible, practical alternatives. It challenges assumptions about growth, redefines what it means to "win" in business, and equips readers with a fresh framework for evaluating value creation beyond short-term gain. By the end, you'll gain clarity on why inclusive capitalism strategies are not fringe experiments but the blueprint of a more stable and humane economy. You'll learn how ethical business growth is no longer a trade-off, but a competitive advantage-and how to align your choices, investments, and organizations with the powerful momentum of community wealth building. This is not a call to abandon capitalism, but to rewire it-so prosperity can finally be shared, sustained, and scaled.

Profit and Principle

What if growing your wealth didn't mean compromising your values? In a world where markets often reward short-term gains at long-term cost, a new approach is rising-one where conscience isn't a liability but an advantage. This book makes the case that aligning your investments with your principles can be the smartest financial decision you ever make. Drawing on history, psychology, and finance, it dismantles the false trade-off between ethics and profit. You'll see how ethical investing protects against hidden risks, why socially responsible investing has outperformed skeptics' predictions, and how ESG investment strategies can create resilience in volatile markets. From the rise of green bonds to the cultural momentum behind conscious capitalism, the evidence is clear: principle and prosperity can compound together. This is not just theory-it's practical. You'll gain frameworks to clarify your own hierarchy of values, build a values-based portfolio, and navigate real dilemmas like whether to divest from imperfect companies or use shareholder influence to demand change. Along the way, case studies and market insights reveal how investors, both large and small, are shaping the future of wealth. Whether you're a seasoned investor, a professional seeking sustainable wealth building, or someone simply unwilling to profit from industries you oppose, this book shows you how finance and ethics can converge. The result is more than financial return-it's the ability to invest with integrity, knowing your capital is not only growing but also contributing to the world you believe in. The new rules of money are clear: investing with conscience isn't a sacrifice. It's the strategy of those building wealth that lasts.

Financial Fables

Numbers may explain money, but they rarely change behavior. What truly shapes financial choices are the stories we grow up hearing, the cultural myths we inherit, and the fables we quietly live by. From tales of greed and scarcity to parables of generosity and debt, the narratives around money have more influence on our decisions than any spreadsheet ever could. This book reveals why understanding money stories for adults is the missing key to lasting financial clarity. Instead of formulas and jargon, it uncovers the hidden cultural money myths and everyday parables that govern how we save, spend, risk, and trust. Along the way, you'll discover why even the smartest plans collapse under the weight of old narratives, and how rewriting those stories gives you back control. Designed for thoughtful readers who crave more than quick hacks, it blends psychology, history, and anthropology with timeless fables to bring the psychology of money decisions into sharp focus. Whether you're struggling with debt, chasing security, or trying to make sense of luck and risk, these insights expose the quiet forces behind your financial habits. Inside, you'll learn how to: - Recognize the invisible myths that keep you stuck - Rethink risk and luck through a storytelling approach to finance - Reframe wealth as values, time, and identity-not just numbers - Choose new narratives that support wiser, calmer decisions By the final page, you'll stop asking for another tip or formula and start seeing every choice through a new lens: finance as story. These are financial fables you'll remember long after the numbers fade-guiding you toward steadier, more intentional decisions and a healthier relationship with money.

Profit Without Burnout

What if growth didn't have to come at the expense of your health, your relationships, or your sanity? In today's hustle-obsessed world, too many entrepreneurs are told the only way to win is to work harder, longer, and faster. Yet chasing success this way often leads to exhaustion, stalled progress, and eventually burnout. This book flips that script, showing that the smartest path forward is not about grinding harder-it's about building smarter. Packed with clear frameworks and real-world examples, it reveals how sustainable business growth can be achieved through clarity, systems, and design-not endless sacrifice. Instead of drowning in to-do lists, you'll discover how time leverage for entrepreneurs turns limited hours into exponential results. You'll learn why delegation frameworks are not a luxury but a necessity, and how to design workplace culture for small business that scales without draining its leaders. This book is for ambitious founders, business owners, and professionals who want to grow their ventures without becoming consumed by them. It offers practical strategies to: - Prevent founder burnout before it undermines your work and your health - Build systems that let you scale a business without overworking - Use energy, focus, and recovery as capital, not afterthoughts - Align profit with freedom, so you can reduce hours and increase profit By the final page, you'll have a complete mental model for growth that works for the long term. You'll see how to build systems not hustle, protect what matters most, and grow a business that creates wealth without breaking its creator. This isn't just survival-it's the blueprint for thriving in both work and life.

The Fail Fast Playbook

A promising idea dies. The costs remain. What if the story did not end there? This book shows how to turn misses into money-without theatrics, shortcuts, or self-deception. It is a field manual for founders, operators, and creators who want rigorous ways to fail fast playbook their work, extract value from what didn't land, and move again with speed and clarity. Inside, you'll learn how to monetise failed experiments using a simple asset inventory: data that still sells, code you can license, and narratives buyers pay to learn from. You'll practice pivot strategy for startups grounded in evidence, not vibes, and master decision kill criteria so you stop late and start sooner. Practical templates walk you through startup post-mortem template structure, learning per dollar metric dashboards, and pathways to salvage markets for code and data where your "waste" becomes someone else's time saved. You'll also get playbooks for repurposing product ideas, pricing knowledge products, and rebuilding morale without spin. This is for founders who hate burning runway, product leaders tired of zombie projects, creators looking to package what they learned, and investors who want cleaner write-ups and better second acts. If you're ready to recover cash, credibility, and optionality from the work that didn't work, this book gives you the operating system to do it-calmly, repeatedly, and on purpose.

The Sacred Routine

Most entrepreneurs know how to work harder-but very few know how to work with presence, steadiness, and meaning. This book reveals why the missing ingredient in modern business isn't another tactic or productivity hack, but business rituals that anchor your energy and mindset in the middle of relentless demands. Through practical and thoughtful practices, it shows how simple routines-morning intention setting, gratitude journaling for leaders, or creating energetic boundaries at work-can transform not just your schedule, but the way you experience leadership itself. Instead of treating work and spirituality as separate, it weaves them together into a framework where everyday actions become grounding forces of clarity. You'll learn how to: - Begin each day with focus and purpose through morning intention setting - Use gratitude journaling for leaders to prevent burnout and reframe setbacks - Protect your energy with clear energetic boundaries at work - End your day with powerful closure rituals that free your mind for rest and renewal - Design personal and team routines that create sustainable workplace culture practices Written for entrepreneurs, founders, and leaders seeking more than short-term success, this book speaks to those ready to replace constant busyness with depth, rhythm, and resilience. Whether you are building a company, leading a team, or redefining your own pace of life, you'll discover that meaningful work is not achieved by doing more-but by ritualizing what matters most. By the end, you will hold a practical model for a sacred routine for business-one that brings balance, clarity, and enduring strength to the way you lead, work, and live.

Beyond Profit

What if the way we measure success is the very thing holding us back? For decades, businesses have been judged by numbers alone-profits, growth charts, quarterly returns. Yet these figures often hide what truly determines resilience: whether teams feel joy in their work, whether leaders act with integrity, and whether organizations are aligned with their deeper purpose. This book introduces a groundbreaking framework for leaders ready to rethink what winning means. It reveals how values-based leadership and workplace culture metrics can be tracked and managed with the same rigor as revenue, creating a second bottom line that drives both financial and human flourishing. Through vivid case studies, research-backed insights, and practical tools, it shows how to design meaningful scoreboards for business ethics and integrity, cultivate organizational alignment, and embed inner metrics for business-such as kindness, presence, and impact-into daily practice. You'll discover how to: - Replace hollow perks with authentic systems that generate measurable joy at work - Use a leadership dashboard for culture that reveals what financial reports miss - Build teams where alignment and trust become long-term assets, not fragile slogans - Adopt the second bottom line performance mindset to future-proof your company Written for entrepreneurs, executives, and anyone shaping culture from within, this book reframes profit as proof of viability-but never the full story. It equips you with the clarity and tools to create organizations where success is measured not just in dollars earned, but in values lived. For leaders seeking a practical yet profound shift, it's both a challenge and a roadmap: the new scoreboard for business in the 21st century.

The Calm CEO

Modern leadership is drowning in noise. Constant emails, endless meetings, and the pressure to always react faster have left executives drained, distracted, and disconnected from what really matters. Yet the leaders who stand out today are not the loudest or busiest-they are the calmest. They cultivate clarity where others spiral into stress, and they make decisions that endure long after the chaos fades. This book redefines leadership by showing why calm leadership is not a luxury but the foundation of lasting success. Drawing on insights from neuroscience, business history, and psychology, it reveals how the most effective leaders harness mindfulness for executives to sharpen judgment, steady their teams, and build cultures of trust. Instead of fueling urgency, you'll discover how to: - Lead high-pressure meetings with presence rather than panic - Manage crises through steady judgment, not frantic reaction - Design a workplace culture calm enough for focus and innovation to thrive - Reclaim mental bandwidth by resisting the myth of constant busyness Whether you are a founder facing uncertainty, a manager juggling competing demands, or a CEO guiding through volatility, this book equips you with a practical playbook for leadership under pressure. Through real-world examples, reflection prompts, and everyday routines, it shows how stillness can become your most powerful strategy. The result is more than reduced stress-it is the emergence of executive presence habits that command trust, inspire loyalty, and deliver stronger results. By the final page, you'll see why in an age of overload, clarity belongs to those who choose calm.

Sacred Workspace

Most workplaces run on endless deadlines, digital noise, and a culture of constant urgency. But beneath the surface, people crave something more-moments of pause, presence, and connection that make work feel meaningful rather than mechanical. This book offers a fresh path: simple, secular practices that transform the everyday office into a place where focus and humanity can thrive side by side. Drawing from psychology, cultural history, and design, it reveals how workplace rituals-from 5-minute meeting check-ins to mindful leadership habits-can bring rhythm and depth back to the modern job. Instead of demanding sweeping changes, it shows how to infuse small, repeatable actions into existing routines, whether you're leading a team, working remotely, or simply trying to stay present in a packed schedule. Inside, you'll discover: - How secular mindfulness at work can sharpen attention without slowing productivity - Why gratitude practices for teams build trust, safety, and shared energy - How to design offices and home setups that promote office design for wellbeing and even incorporate biophilic office design - The science of energy management at work and why managing energy, not hours, is the real key to sustainable performance - Rituals tailored for remote teams that foster real connection across screens Perfect for managers, entrepreneurs, and thoughtful professionals, this book helps readers reclaim agency in the face of modern overwhelm. By the end, you won't see rituals as luxuries or add-ons-you'll understand them as essential structures that turn routine into renewal, and work into a space where both productivity and presence finally belong.

The Resilience Mindset

When the economy falters, most people react with fear-cutting back, freezing up, and hoping to outlast the storm. But downturns don't just take things away; they reveal new paths for those who know how to think differently. This book offers a fresh blueprint for building resilience during economic downturns, showing how ordinary people can protect themselves, stay calm, and even find opportunity when everything seems uncertain. Instead of focusing only on numbers in a bank account, it reveals why true stability comes from mindset, adaptability, and small but strategic actions that compound over time. Through real-world examples, practical frameworks, and reflection tools, it helps you: - Create diversify income streams with side hustles and skill-building that act as shock absorbers - Strengthen family financial stability by redesigning household roles and conversations about money - Apply risk management for individuals that reduces fragility and increases optionality - Cultivate emotional resilience and money habits that prevent fear-driven mistakes - Recognize undervalued opportunities and thrive in places others overlook This isn't theory-it's a step-by-step approach grounded in history, psychology, and decision science, designed for workers, families, and entrepreneurs alike. Whether you're worried about job security, navigating a shrinking paycheck, or trying to make smart moves in uncertain times, the tools here turn anxiety into clarity. By the final page, you'll hold a clear mental model for thriving in tough economies: one that goes beyond survival to help you design a life less dependent on forecasts and more rooted in calm, confidence, and choice. For anyone asking how to truly become recession proof in personal finance, this book delivers both the mindset and the moves that matter.

The End of the Paycheck

The paycheck was once a symbol of stability. Today, it's one of the greatest risks you can depend on. In a world of layoffs, automation, and economic shocks, tying your entire livelihood to a single employer is no longer security-it's fragility. The path forward is not about chasing endless hustle, but about designing multiple streams of income that provide flexibility, resilience, and control. This book is a practical blueprint for professionals, freelancers, and aspiring investors who sense that the old model of work no longer fits. Instead of vague promises of easy money, it reveals how to strategically combine side income ideas for professionals, freelancing to replace salary, royalties and passive income, and cash flow investing for beginners into a coherent income portfolio strategy. Each stream may start small, but together they create an ecosystem of stability-one that protects you from volatility and opens up new choices in how you live and work. You'll learn why one job is riskier than many, how to avoid the trap of scattered hustles, and how to align your time, skills, and resources into a portfolio that compounds security. Real-world examples and practical exercises make it clear how ordinary people have built resilient financial lives-without gambling on trends or chasing hype. Whether you want to escape the single paycheck, diversify income sources, or build financial resilience for your future, this book offers the clarity and structure you need. It's not about working more, but about designing smarter systems of income that put you back in control of your time, energy, and options. The future belongs to those who stop waiting for one paycheck and start building many.

The Money Mind

Most people think financial freedom comes from earning more-but the truth is that income alone won't break the cycle of stress, overspending, and scarcity. The real driver of your financial life is hidden beneath the surface: the unconscious money patterns you learned in childhood, the emotions tied to your spending, and the habits you repeat without realizing it. This book exposes why smart, hardworking people still struggle with money. It reveals how childhood money scripts shape adult decisions, why emotional spending triggers sabotage your goals, and how cultural pressure to "look successful" keeps you broke. Through psychology, behavioral economics, and real-world examples, it explains the hidden logic behind why saving feels painful, why debt feels safer than change, and why even disciplined people fall into self-sabotage. Written for anyone who's tired of living paycheck to paycheck despite knowing better, this book speaks directly to professionals, entrepreneurs, and everyday readers who sense that the numbers never quite add up. It doesn't offer generic budgeting tips-instead, it provides a clear framework to identify your blind spots, disrupt destructive cycles, and rewire your money habits for lasting freedom. Inside, you'll learn how to: - Recognize the hidden money habits that undermine progress - Break free from unconscious money patterns that keep you stuck - Reframe saving, debt, and spending in ways that align with your values - Replace shame and avoidance with clarity and confidence By the final page, you won't just understand the psychology of saving and spending-you'll have the mental model and practical tools to finally live on your own terms. Your income doesn't define you. Your money mindset does. And once you change it, everything else follows.

The Product Manual

The Product Manual: The Complete Survival Guide for New Product ManagersYou've got the PM job. Congratulations. Now what?Most product management books assume you already know what you're doing, which is adorable. After 20+ years building products and managing teams, Jason Brynford-Jones has written the practical product management guide he wished he'd had starting out. No framework fantasies, no advice without the how or the why. Just veteran wisdom and real examples from the trenches. This is the book for product managers who actually need to do the job, not for those who just want to sound smart on LinkedIn.Inside, you'll find out what actually matters: Learning how to say noLeading without formal authorityPerforming product and people inventoriesMaking decisions in the absence of dataNavigating tricky stakeholder relationshipsDecoding why estimates are always wrongValidating ideas so you don't build the wrong thingProduct management is a role no one can properly define, but everyone will hold you accountable for. You'll lead without authority, make decisions without perfect information, and deliver value without agreement on what that means. You'll bridge gaps no one admits exist, answer questions no one asked until too late, and inherit ambiguity as a birthright. You're somewhere between diplomat, janitor, and shepherd, while half your team won't understand what you actually do. This ironic ambiguity is permanent.This book won't lie to you about any of it. Brace yourself.Written with zero patience for shallow fluff and unactionable advice. If you want feel-good platitudes, buy a different book. If you want to finally know how to actually get things done, start here.

Trade the 50 Day

Do you want to get started in the stock market, but you're worried you don't know enough to make the right investments?You don't need a complex system, a fancy degree, or a full-time career as an investor to get great returns. You just need to trade the 50-day moving average.Trade the 50 Day teaches you how to invest in the stock market and outperform it, all by following the 50-day moving average. Most portfolio managers do not average a ten percent rate of return; this book helps you accomplish just that, whether you're a seasoned investor or a first timer, with just four or five trades a year. Take the stress out of investing and say goodbye to worrying every time the stock market falls.When you're using the trade the 50 day system, you finally let go of fear and embrace real returns.

Trade the 50 Day

Do you want to get started in the stock market, but you're worried you don't know enough to make the right investments?You don't need a complex system, a fancy degree, or a full-time career as an investor to get great returns. You just need to trade the 50-day moving average.Trade the 50 Day teaches you how to invest in the stock market and outperform it, all by following the 50-day moving average. Most portfolio managers do not average a ten percent rate of return; this book helps you accomplish just that, whether you're a seasoned investor or a first timer, with just four or five trades a year. Take the stress out of investing and say goodbye to worrying every time the stock market falls.When you're using the trade the 50 day system, you finally let go of fear and embrace real returns.

Empire State of Mind

The Unspoken Secrets of Building Wealth from the Ground UpEver wondered how the rich keep getting richer, or what hidden strategies lie behind their success? Empire State of Mind pulls back the curtain, revealing the mindset, focus, and savvy moves that are key to building wealth and creating your own empire-starting with real estate, even if you have $0 to invest upfront. Set against the electric backdrop of Las Vegas, this book dives into the gritty realities and thrilling stories of those who have mastered the game. With insights drawn from real Vegas deals and hard-won lessons, Empire State of Mind is a powerful, hands-on guide for anyone ready to go all-in. You'll learn strategies the rich don't talk about, the importance of developing an unbreakable mindset, and, most importantly, how to start building wealth today without breaking the bank. Get ready to think bigger, live bolder, and start building the empire of your dreams-Vegas-style.

The Ultimate Collection of Fun Things to Do in Retirement

Ready to Transform Your Retirement into the Best Years of Your Life? Discover the Roadmap to a Fun, Fulfilling, and Meaningful Retirement!Do you dream of spending your golden years traveling to breathtaking destinations or discovering hobbies that spark joy?Are you unsure how to stay mentally sharp, socially active, and physically fit without feeling overwhelmed?Do you wonder how to balance exploration and relaxation while finding a sense of purpose in retirement?With this inspiring two-book collection, you'll discover how to stay active, curious, and connected, ensuring your retirement years are filled with excitement and meaning: A world of travel possibilities: Learn the secrets to budget-friendly trips, senior discounts, and worldwide adventures tailored to your fitness level and interests.Outdoor hobbies for every lifestyle: From kayaking and hiking to bird-watching and hot-air ballooning, find activities that energize your body and soul.Creative pursuits that spark joy: Explore painting, home decor projects, artisan bread-making, and other hobbies that bring fulfillment and beauty into your life.Intellectual engagement and growth: Learn new skills, explore lifelong learning opportunities, and discover how to keep your mind sharp with fascinating activities.Ways to connect and leave a legacy: From mentoring and volunteering to documenting family history, uncover meaningful ways to contribute to your community and loved ones.The Ultimate Collection of Fun Things to Do in Retirement is your ultimate guide to living a joyful, adventurous, and creative life in retirement.If you enjoy practical advice, inspiring ideas, and actionable steps to make the most of your retirement, then you'll love Lara West's insightful and motivating collection.

Own the Room

If you've ever walked into a room and felt invisible...If you've ever spoken and watched people glaze over...If you've ever walked away thinking, "I should've said that..." - this book is the turning point.Own the Room isn't another communication book packed with clich矇s and reheated advice. It's a real-time playbook for reading people, decoding behavior, and showing up with a presence so clear and confident that people have no choice but to listen.Inside, you'll learn how to: Read people in real time - their posture, tone, rhythm, urgency, and unspoken cuesSpeak with calm authority, even in high-stakes conversationsCommand any room without force, pressure, or performanceInfluence decisions ethically by understanding what people really meanAdjust your communication style instantly so conversations don't spiral or stallEarn respect the moment you open your mouthHandle difficult people without losing your composure or your powerUsing a blend of behavioral psychology, social dynamics, and Jake Stahl's proprietary STRATA framework, you'll discover the mechanics behind presence - what actually makes someone magnetic, trusted, and impossible to ignore.Whether you're a founder, fractional leader, executive, solopreneur, or anyone who deals with humans on a daily basis, this book gives you the tools to: understand body language and hidden signalsstay confident under pressurecommunicate so people lean in, not awayturn conversations into opportunitiesstep into rooms as the most prepared, grounded version of yourselfIf you've ever wanted to know how to speak so people listen, how to get respect without raising your voice, or how to control the first five seconds of any interaction, this is your manual.

How To Make 17/18 Profit Days In 22 Trading Days

This book is about the Indian market's Bank Nifty Index Fund, which is currently one of the most profitable tools in the Indian market. It introduces a strategy that can be used by any type of trader, whether you are a beginner or an advanced intermediate. Using this setup, you can generate a consistent income.After reading this book, you will understand that daily profits in the market are not guaranteed. However, if you follow the rules and setup outlined in this book, your portfolio will remain in the green every month. Therefore, this book is suitable for everyone who wants to start their trading journey in the stock market or has already begun. It covers everything from the basics to advanced concepts, along with the setup.

Tessa--The Trader's Wife

In the shimmering heat of the late 19th century Pacific islands, where the azure waves whisper secrets of the past, a tale of adventure romance unfolds. Amidst the vibrant tapestry of colonial era trade, a marriage and relationships are tested by the tumultuous cross-cultural encounters that define this historical fiction novel. The protagonist's journey through the complexities of love and loyalty echoes the timeless struggles faced by those who dare to navigate the heart's uncharted waters. This book was out of print for decades and is now republished by Alpha Editions, offering readers a chance to rediscover a forgotten gem. Set against the backdrop of Polynesian islands, the narrative captures the essence of a world where the old ways and new ambitions collide. Fans of Louis Becke and readers of sea tales will find themselves drawn into a world reminiscent of Robert Louis Stevenson and Joseph Conrad, where the allure of the unknown beckons with every turn of the page. Restored for today's and future generations, this edition is not just a reprint-it's a collector's item and a cultural treasure. Its revival speaks to the enduring power of storytelling to bridge time and space, inviting both casual readers and classic-collection buyers to immerse themselves in a story that resonates with the rhythms of the sea and the echoes of history.

Hedge Fund Market Wizards

Fascinating insights into the hedge fund traders who consistently outperform the markets, in their own words From bestselling author, investment expert, and Wall Street theoretician Jack Schwager comes a behind-the-scenes look at the world of hedge funds, from fifteen traders who've consistently beaten the markets. Exploring what makes a great trader a great trader, Hedge Fund Market Wizards breaks new ground, giving readers rare insight into the trading philosophy and successful methods employed by some of the most profitable individuals in the hedge fund business. Presents exclusive interviews with fifteen of the most successful hedge fund traders and what they've learned over the course of their careers Includes interviews with Jamie Mai, Joel Greenblatt, Michael Platt, Ray Dalio, Colm O'Shea, Ed Thorp, and many more Explains forty key lessons for traders Joins Stock Market Wizards, New Market Wizards, and Market Wizards as the fourth installment of investment guru Jack Schwager's acclaimed bestselling series of interviews with stock market experts A candid assessment of each trader's successes and failures, in their own words, the book shows readers what they can learn from each, and also outlines forty essential lessons--from finding a trading method that fits an investor's personality to learning to appreciate the value of diversification--that investment professionals everywhere can apply in their own careers. Bringing together the wisdom of the true masters of the markets, Hedge Fund Market Wizards is a collection of timeless insights into what it takes to trade in the hedge fund world.

Narratives that Change Minds

Among the most challenging tasks any leader faces are communicating to various audiences how to change behaviors to limit risks, address crises, and change the way an organization operates-especially as they relate to scientific and technical issues. Executives, managers, and public officials deal with multiple audiences-employees, boards, and the public-who may have competing perspectives or lack an understanding of technical or scientific issues affecting them.Narratives that Change Minds provides a framework for analysis and case studies of leadership successes and failures relative to communicating risk, crisis, and organizational change within technical contexts. A unique feature of this book is its consideration of neuroscience elements that affect how audiences respond to messages, including narratives. The goal is to help managers and executives understand how to incorporate narratives to improve the likelihood of facilitating needed change.Drawing on scholarship about how the brain processes information from different stimuli and experiences, we will explore the whys and hows of effects multiple forms of communication that integrate narratives have on individuals. A practical model is included to provide guidance to executives in effectively applying principles drawn from leadership resources. This unique approach makes the book an excellent addition to reading lists of leadership development and communication programs.Executives and those in such development programs will benefit from this book, especially with its focus on crisis and change communication. Whether they have technical background in their field or come from a managerial background, readers will come to understand how they can help audiences accept the need for change related to risk, crisis, or organizational/policy issues and act on that change.

J.K. Lasser's 1001 Deductions and Tax Breaks 2026

Save money--legally--on your 2025-26 taxes with easy, expert advice from America's most trusted personal and small business tax advisor In the newly revised edition of J.K. Lasser's 1001 Deductions and Tax Breaks 2026: Your Complete Guide to Everything Deductible, renowned tax expert Barbara Weltman walks you through every relevant tax credit and deduction you're entitled to claim on your 2025 return, including brand new tax breaks introduced just this year. You'll find hundreds of money-saving opportunities that help ensure you don't overpay on your taxes, giving Uncle Sam exactly what you're legally required to give him - and not a penny more! You'll also find: A complimentary e-supplement that covers the latest developments from the IRS and Congress Step-by-step instructions on how to claim every deduction that applies to you and your family, complete with record-keeping requirements, dollar limits, and filing instructions The latest tax rulings, laws, and cases that impact your 2025-26 tax return Perfect for every individual U.S. taxpayer who has ever wondered, "Can I deduct this expense?" or "Will the IRS say no to that tax credit?", J.K. Lasser's 1001 Deductions and Tax Breaks is a straightforward and authoritative roadmap to saving money on your taxes and simplifying tax season.

The Truth about College

An unbiased, accurate, and up-to-date guide to making college-related decisions Should I go to college? Which college should I go to? When should I go? What should I study? How should I pay for college? Should I work while I'm attending? In The Truth About College: The essential guide to help your teenagers succeed - so college doesn't ruin their lives, #1 New York Times bestselling author, Ric Edelman, delivers an unbiased and eye-opening guide for parents who want to help their children answer their college questions and for the teenagers doing their best to make the "right" choice. This is not an anti-college screed or a full-throated endorsement of college for everyone. It's a deeply researched decision-making guide that carefully considers the unique characteristics, considerations, and circumstances that will influence college-related decisions. The book recognizes that college is not a subject that should be considered through an ideological lens. It shouldn't be one characterized by snap decisions or decisions made based on what peers or parents did or didn't do. Instead, you'll learn all about the real-world benefits and costs of attending college today. You'll discover the doors it unlocks, the doors it closes, the most common mistakes made by college students, and how to minimize the downsides and cost if you or your child decide to attend. Inside the book: A comprehensive and accurate exploration of the specific information that you and your child need to make the most beneficial decisions possible Concise summaries at the end of each chapter for easy review, as well as a standalone, step-by-step guide to talking with your teenagers about college Clear-eyed, unbiased advice from an experienced finance professional based on contemporary evidence and data about college and the college experience Perfect for all teenagers preparing to go (or not go) to college and their parents, The Truth About College is packed with the information you need to make smart decisions that will be beneficial over the long-term.

Solana Rising

Discover the next huge opportunity in the cryptocurrency space: the Solana blockchain In Solana Rising, founder and co-managing partner of SkyBridge Capital, Anthony Scaramucci, delivers an exciting and authoritative account of one of the true generational trades available in today's market: the Solana blockchain. Representing digital liquidity, Solana offers its users the ability to tokenize and liquidize illiquid assets. Perfect for intermediate-level crypto investors who are comfortable owning Bitcoin - and are now ready to take the next step into the world of Solana - the book explains how this blockchain works, why it's so transformative, and how it accomplishes what it does. Readers will also find: Discussions of the investors and players currently betting big on Solana A step-by-step guide to getting started with Solana and the role it should play in a crypto portfolio Advice for spotting new and emerging trends in cryptocurrency Most of us missed the bulk, or even the entirety of, Bitcoin's march from $0.01 to $100,000. Solana Rising is your opportunity to get in near the ground floor of a technology with even more potential.

The Career Reinvention Blueprint

Have you ever felt restless in your career-successful on the outside yet unfulfilled within?You're not alone. Many professionals reach a point where the work they once pursued no longer fits who they're becoming.The Career Reinvention Blueprint(TM) is your roadmap for navigating that turning point with clarity and courage.Through seven transformational steps, it guides you from confusion to confidence, and from restlessness to realignment.Blending personal stories, lived leadership, and actionable strategies, Dr David Onu shares a practical, hopeful framework for professionals seeking alignment between success and purpose.Whether you are: An early-career professional wondering "What's next?"A successful midlife leader who feels strangely restlessA business owner or freelancer hungry for new directionOr a retiree searching for meaning beyond a well-earned restThis blueprint will help you: Realign with what matters mostRedefine success on your own termsRewrite your story with intention, clarity, and impactThe Career Reinvention Blueprint(TM) is more than a book-it's a journey from restless to realigned.

J.K. Lasser's Your Income Tax 2026

The most up-to-date entry in America's #1 all-time best-selling personal tax guide J.K. Lasser's Your Income Tax 2026: For Preparing Your 2025 Tax Return delivers practical and hands-on guidance for everyday people preparing to file their taxes for the 2025 calendar year. You'll find timely and up-to-date info about the latest changes to the US tax code, as well as worksheets and forms you can use to make filing your taxes easier. You'll get the most current insight on how to maximize your credits and deductions, keeping more money in your pocket. In the latest edition of this celebrated and best-selling series, you'll find: Special features that walk you through the most recent Tax Court decisions and IRS rulings that determine how your deductions and credits will work Simple tips and tricks on how to properly file your taxes, as well as tax planning strategies that save you and your family money Full updates on the One Big Beautiful Bill Act and how it could impact your tax A revised and expanded section on cryptocurrency. Trusted by hundreds of thousands of Americans for over 80 years, J.K. Lasser's Your Income Tax 2026 is the perfect resource for everyone looking for the latest and most up-to-date personal tax information to make filing their next tax return a breeze.

Get Better with Money - How to Unlock the Path to Financial Freedom

Imagine Your Bank Account 12 Months From Now - What If Small Daily Shifts Could Unlock Big, Lasting Change? Even if you've struggled with money management your entire life.Are you tired of living paycheck to paycheck, never getting ahead-no matter how hard you work?Do you wonder if it's too late to start saving for retirement, or feel lost trying to invest with limited time and knowledge?Do you wish you could stop emotional spending and finally feel secure, confident, and in control of your money?If you answered "yes" to any of these, you're not alone. Most busy adults face these same challenges-balancing work, relationships, and life's curveballs while seeking clarity, confidence, and a more effective way to manage their finances.Get Better with Money - How to Unlock the Path to Financial Freedom is your straightforward, relatable guide to taking charge of your financial life.You don't need a finance degree, a six-figure salary, or endless spare time. All you need is a starting point, clear explanations, and the motivation to act.This book delivers just that-plus the encouragement and tools to help you stay on track, even when life gets busy.Here's just a glimpse of what you'll discover inside: The psychology of money: How your beliefs and cultural background shape your bank account, and how to rewrite your money story.Seven money mindset shifts to turn money anxiety into lasting confidence-these 7 rules will build a foundation for achieving financial independence.A proven debt-snowball method that fits your real life, with clear examples and actionable steps.How to create a realistic budget you'll actually stick to-without constant sacrifice or guilt.Effective ways to stop emotional spendingThe essentials of investing: stocks, bonds, ETFs, and crypto explained simplyTools and apps to simplify money management-no tech expertise required.Checklists and examples for every chapter to make progress easy, actionable, and fun....and much more!If you think "budgeting never works for me" or "investing is just too risky," or that "it's too late to start," this book will change your perspective. You don't need to be perfect, and it's never too late to start.This guide is specifically designed for individuals with busy schedules, debt concerns, or a history of financial difficulties.Each strategy is broken down into simple, actionable steps so that you can make progress-even with just a few minutes a day.No dense jargon, no lectures, no shame-just clear advice and the support you need to finally take control.Ready to unlock your path to financial freedom?

Get Better with Money - How to Unlock the Path to Financial Freedom

Imagine Your Bank Account 12 Months From Now - What If Small Daily Shifts Could Unlock Big, Lasting Change? Even if you've struggled with money management your entire life.Are you tired of living paycheck to paycheck, never getting ahead-no matter how hard you work?Do you wonder if it's too late to start saving for retirement, or feel lost trying to invest with limited time and knowledge?Do you wish you could stop emotional spending and finally feel secure, confident, and in control of your money?If you answered "yes" to any of these, you're not alone. Most busy adults face these same challenges-balancing work, relationships, and life's curveballs while seeking clarity, confidence, and a more effective way to manage their finances.Get Better with Money - How to Unlock the Path to Financial Freedom is your straightforward, relatable guide to taking charge of your financial life.You don't need a finance degree, a six-figure salary, or endless spare time. All you need is a starting point, clear explanations, and the motivation to act.This book delivers just that-plus the encouragement and tools to help you stay on track, even when life gets busy.Here's just a glimpse of what you'll discover inside: The psychology of money: How your beliefs and cultural background shape your bank account, and how to rewrite your money story.Seven money mindset shifts to turn money anxiety into lasting confidence-these 7 rules will build a foundation for achieving financial independence.A proven debt-snowball method that fits your real life, with clear examples and actionable steps.How to create a realistic budget you'll actually stick to-without constant sacrifice or guilt.Effective ways to stop emotional spendingThe essentials of investing: stocks, bonds, ETFs, and crypto explained simplyTools and apps to simplify money management-no tech expertise required.Checklists and examples for every chapter to make progress easy, actionable, and fun....and much more!If you think "budgeting never works for me" or "investing is just too risky," or that "it's too late to start," this book will change your perspective. You don't need to be perfect, and it's never too late to start.This guide is specifically designed for individuals with busy schedules, debt concerns, or a history of financial difficulties.Each strategy is broken down into simple, actionable steps so that you can make progress-even with just a few minutes a day.No dense jargon, no lectures, no shame-just clear advice and the support you need to finally take control.Ready to unlock your path to financial freedom?

Averagely Rich

Most investing advice is either too simple to work, or too complex to follow.Averagely Rich bridges that gap with an evidence-based guide to building wealth the realistic way: no hype, no gimmicks, and no financial jargon.Whether you're just starting your personal finance journey or looking to strengthen your long-term investing strategy, this concise 100-page guide shows you how to grow wealth step by step using facts, not speculation.What you'll learn inside: A brief history of the stock market, and why it still works for regular investors today.How to start investing even with small amounts of money.Evidence-based asset allocation strategies that match your goals and risk tolerance.What research and real market data say about long-term returns in the U.S. and Canada.How to think about retirement, rebalancing, and staying calm through market cycles.Backed by decades of historical market data and academic finance studies, Averagely Rich cuts through myths and emotions with clear visuals and actionable insights.If you want a realistic, data-driven path to financial freedom, one that works for ordinary people, this book is your starting point.Get your copy today and start building your own version of averagely rich: steady, informed, and financially free.

Fortune's Formula

An updated edition of the classic book that introduced the world to the controversial money-making formula known as the Kelly system. In 1956, two Bell Labs scientists discovered the scientific formula for getting rich. One was the mathematician Claude Shannon, neurotic father of our digital age, whose genius is ranked with Einstein's. The other was John L. Kelly Jr., a Texas-born, gun-toting physicist. Together they applied the science of information theory--the basis of computers and the internet--to the problem of making as much money as possible, as fast as possible. Shannon and the MIT mathematician Edward O. Thorp took the "Kelly formula" to Las Vegas. It worked. They realized that there was even more money to be made in the stock market. Thorp used the Kelly system with his phenomenally successful hedge fund, Princeton-Newport Partners. Shannon became a successful investor, too, topping even Warren Buffett's rate of return. Fortune's Formula traces how the Kelly formula sparked controversy even as it made fortunes at racetracks, casinos, and trading desks. It reveals the dark side of this alluring scheme, which is founded on exploiting an insider's edge. Featuring a new preface and sixty pages of new material, this 20th anniversary edition of William Poundstone's classic book is the definitive account of the betting system that forever changed our understanding of risk-taking.

Penguin Select Classics: How to Win Friends and Influence People

Millions of people around the world have - and continue to - improve their lives based on the teachings of Dale Carnegie. In How to Win Friends and Influence People Carnegie offers practical advice and techniques, in his exuberant and conversational style, for how to get out of a mental rut and make life more rewarding.This premium paperback edition, featuring elegant gold foiling, provides a luxurious reading experience that complements its timeless wisdom. His advice has stood the test of time and will teach you how to: Make friends quickly and easilyIncrease your popularityWin people to your way of thinkingEnable you to win new clients and customersBecome a better speaker and a more entertaining conversationalistArouse enthusiasm among your colleaguesThis book will turn around your relationships and improve your dealings with all the people in your life.

Penguin Select Classics: The Richest Man in Babylon

THE SECRET OF THE RICH ISN'T A SECRET AT ALL Hailed as the greatest of all inspirational works on personal finance, The Richest Man in Babylon brings together the famous 'Babylonian parables' that have helped countless readers amass wealth and success. This modern classic offers an understanding of, and a solution to, your personal financial problems. Narrated in simple everyday language, these fascinating and informative stories will tell you everything you need to know about thrift, financial planning, and personal wealth. The ancient Babylonians were the first to discover the universal laws of prosperity, and now you can master them too! Timeless financial wisdom: Learn principles that have stood the test of timeAchieve lasting wealth: Strategies to build and maintain wealthPractical advice: Easy-to-understand tips for financial successHistorical insights: Gain knowledge from ancient Babylonian parablesInspiring stories: Motivational tales that encourage smart financial decisions

Penguin Select Classics: Think and Grow Rich

Discover the timeless secrets to wealth and success with Think and Grow Rich, a groundbreaking work by Napoleon Hill. After 25 years of research and interviews with over 500 of the most prosperous individuals of his era, Hill revealed a proven formula based on mindset and behavior to unlock financial achievement. This updated edition features new insights and inspiring success stories from modern icons, proving that these principles remain powerful tools for anyone ready to transform their life and reach their fullest potential.Key Features: Elegant gold foiling and premium paperback design for a luxurious reading experienceClassic wealth-building strategies refined through decades of researchUpdated edition includes success stories of contemporary leaders like Bill Gates and Steven SpielbergClear, actionable thirteen-step formula to develop a millionaire mindsetPractical guidance to set and achieve ambitious personal and financial goals

HR Approved Ways to Deal With Stupid Coworkers

You know that one coworker that makes you seriously question all your career choices? Here's the ultimate survival guide to deal with them. This brutally funny, painfully relatable guide teaches you how to survive office life without losing your job or your last shred of sanity.Highlights include: Passive-Aggressive Communication Styles Ranked from "Mildly Petty" to "Requires Intervention" - Master your polite-but-deadly corporate tone.Performance Review Prep: How to Spin "I Survived This Year" into "Exceeds Expectations" - Turn endurance into "strategic leadership."Meetings That Could've Been Emails and Other Crimes Against Productivity - Save your calendar. Save your soul.Team Building Activities and Other Forms of Psychological Warfare - Navigate "mandatory fun" without emotional scarring.A Beginner's Guide to Boundary-Setting: Say No Without Saying "F This Job" - Professional limits without professional fallout.If you've ever muted yourself on Zoom just to scream into the nearest pillow, this is your handbook for surviving the modern workplace-one HR-approved insult at a time.Buy one for you, one for your work bestie (because some coworkers are actually nice), and one to "accidentally" leave in the breakroom for every other poor soul just trying to make it to Friday.

Taxes for Humans Workbook

A practical and caring workbook to help you simplify your taxes as a self-employed person, including mindset-shifting exercises, practical checklists, and simple systems to get your US taxes feeling simpler. In the Taxes for Humans Workbook, seasoned self-employed artist and tax educator Hannah Cole delivers a hands-on workbook for freelancers, solopreneurs, creatives, and students navigating the American tax system. This Workbook supplements Cole's Taxes for Humans book with mindset exercises, checklists, helpful illustrations, and other practical tools you can use immediately to get your taxes done with confidence and simplify them moving forward. The resources in this book will help you get financially comfortable, smarter, and more organized. You'll learn simple systems to improve your tax records and bookkeeping, and IRS-proof your taxes as a self-employed (Schedule C) person. You'll also find: Bookkeeping and organization tools you can apply right away to make sense of your finances Illustrations that make taxes understandable for visual learners Mindset prompts that help you with the emotional side of doing your taxes, and leading you to stress-free, easy management of your small business/freelance dollars. Perfect for freelancers, artists, and other self-employed people, Taxes for Humans Workbook offers the tools and resources you need to successfully navigate your taxes with calm, confidence and self-compassion

How to Buy a House in California

Strategies that work in California's unique marketLooking for a house in the Golden State? This bestselling book, written specifically for California, will show you how to find a house you can afford and will enjoy living in for many years.You'll save time and money by learning how to: choose a house and neighborhood you'll loveselect and manage a knowledgeable, hard-working agentqualify for the best mortgagefigure out how much down payment you can affordmake an offer and negotiate a good dealcompete in multiple-bid situationsinspect a house for problems and hazardsbuy and sell houses simultaneously, andget through escrow successfully.This 19th edition is completely updated to address new difficulties in obtaining affordable insurance and a mortgage.Packed with checklists and financial information, How to Buy a House in California will guide you step-by-step through the challenges of purchasing a home in California.