An Evaluation of the Suitability of Air Force Operations and Maintenance Funding For Use in a Nomothetic Model

The Department of Defense's Planning, Programming, Budgeting and Execution process provides the foundation for integrating mission requirements with limited resources. However, in doing so, it places a significant burden on financial management professionals frequently requiring that critical, skilled resources be occupied with creating documentation rather than in accomplishing higher level analysis. It is possible that models could be used within the PPBE process to streamline the work done to provide estimates of needed resources. However, such a model would be valid only if it could be proved that the data used within the model was suitable for such purposes. A nomothetic model could potentially be the modeling framework but only if the source data met the model's three criteria.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

A Delphi Expert Assessment of Professional Certification Programs for Contracting Personnel

This study examined the strategic goals that were the basis for the DoDs implementation of mandatory certification for individuals serving in the contracting career field of the acquisition workforce. The study then went on to enlist panels of contracting experts to assess the extent to which two of the available certification programs meet, or fail to meet, those goals. The research method employed to gather input from experts was a Delphi discussion technique. Two separate panels, one consisting of Air Force civilian employees, the other of Air Force active duty officers, participated in eight Delphi iterations facilitated by the researcher.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Jet Fuel Hedging Strategies for the Department of Defense Through Use of Financial Derivatives

The primary purpose of this research is to assess the practicality of utilizing some of the financial derivative products available on the market today in an effort to mitigate monetary losses due to the increasing price of jet fuel, thereby increasing stability in the DOD budget. The scope of this research will focus on the use of futures and call option contracts. Domestic jet fuel expenditure data was collected for Fiscal Years 1996 to 2007 and cross-referenced with the contract process of the previously mentioned financial hedging instruments during the same period of time. Results from the ex post facto analysis indicate that hedging with either heating oil futures or heating oil call options would have provided a tremendous overall savings to the DOD. Currently the DOD does not hedge its budget against fluctuation in the jet fuel spot market. The implication from this study is that the DOD should consider hedging its jet fuel exposure with either derivative, in particular call options as it is tailored for risk adverse customers.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

An Analysis of the Federal Acquisition Streamlining Act and the Clinger-Cohen Act and Their Effect on Cost Overruns in Department of Defense Contracts

This thesis examines the impact of the Federal Acquisition Streamlining Act (FASA) of 1994 and the Clinger-Cohen Act on cost overruns in Department of Defense (DoD) contracts. Many officials believe that we must change the way we do business to meet the new post-Cold War national security challenges. Changing the way we do business means reforming the acquisition process to deliver weapons systems faster and cheaper. The FASA and the Clinger-Cohen Act made more changes to the acquisition process than any other policy had in the ten years proceding. This research effort studied 220 contracts completed between December 31,1993 and December 31,2001 to determine if cost overruns on contracts completed before the implementation of the FASA and the Clinger-Cohen Act were different than cost overruns on contracts completed after the implementation of the FASA and the Clinger-Cohen Act. The contracts were also subdivided to determine if the results were sensitive to acquisition lifecycle phase, branch of service, or contract type. The results indicate that cost overruns decreased on completed contracts after the implementation of the legislation. The results were sensitive to the branch of service responsible. Air Force contracts experienced no change in cost overruns after the implementation of the FASA and the Clinger-Cohen Act, while cost overruns in Army and Navy contracts decreased. The results were not sensitive to lifecycle phase or contract type.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Buying a Better Air Force

The purpose of this study was twofold: to capture the United States (US) government's revealed preference for air superiority using the hedonic pricing approach (HPA) and compare the characteristics of United States Air Force (USAF) fighter aircraft with those of the former Soviet Union to evaluate the effectiveness of the USAF fleet. The resulting analysis showed that the US government is paying for physical and performance characteristics such as engine thrust, service ceiling, range, and large scale integrated circuit technology. However, evidence suggests the government is not paying to have a relative advantage over the enemy based on the physical and performance characteristics analyzed.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Establishing a Foundation to Capture the Cost of Oversight for a Major Defense Program Within the Information Technology Acquisition Community

In 1970 the Department of Defense introduced the Department of Defense Directive 5000 to standardize the acquisition process; the directive created oversight forums to ensure the policies and procedures created were followed, track program progress, and identify programs in trouble. Although oversight was essentially created to help reduce the cost of acquisitions, there is reason to believe that it may increase the costs; however, because there has only been a few studies conducted that estimated the cost of oversight no one knows how much oversight costs individual programs. Numerous oversight processes are being used today, but no research shows one process is any different from the other. Nor have studies been done to determine the cost drivers for oversight. This thesis will provide a foundation and potential cost saving recommendations that would benefit the Department of Defense in most of the acquisition programs it monitors. An estimated cost of oversight will be calculated for programs following three different oversight processes using the Delphi Methodology. The estimates will be compared to determine if there are any statistical differences between them. A future track for the next generation of oversight processes will develop from the recommendations.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Better, Faster, Cheaper

The erosion of America璽€Ÿs industrial base since World War II has affected national security by decreasing the available production and intellectual capacity. Some factors attributing to this phenomenon are the reduction in the number of firms in the defense industry, budgetary issues brought about by today璽€Ÿs fiscally constrained environment, the practice of outsourcing capabilities overseas, the lack of a threat to state survival, and the increased specialization of the defense industrial base. Additionally, the defense acquisition organizational structure is out of balance. To function efficiently and effectively, defense acquisition must strike a balance between the requirements generation and approval process, the budgeting process, and the method by which defense acquisition professionals acquire materiel solutions. However, the lack of common oversight, prioritization and the conflicting timelines of the three decision support systems affect national security by limiting the options and capabilities available to the warfighter. To this point, Department of Defense leadership has tried to remedy the problem by placing emphasis on reforming how defense acquisition professionals go about procuring weapon systems under the auspices of "acquisition reform." However, acquisition professionals and Department of Defense (DoD) leadership are wasting their time because the current effort simply addresses symptoms of the problem, not the problem itself. The real dilemma in the defense acquisition system is the incompatibility in the "reward system" of the various stakeholders in defense acquisitions. Solving the overall problems in the defense acquisition enterprise requires a more robust and flexible industrial base, more interaction and harmony between the acquisition decision support systems and adequately addressing the core interests of the various stakeholders in the defense acquisition enterprise. Until then, the acquisitions community will never see true reform.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Governmental Ownership the Alternative of Governmental Rate-Making

In "Governmental Ownership the Alternative of Governmental Rate-Making," Joseph Nimmo presents a detailed critique of governmental control over industries and utilities. Published in 1905, this work offers a historical perspective on the debates surrounding government intervention in the economy. Nimmo argues against the practicability and questions the revolutionary implications of governmental rate-making, advocating instead for alternative regulatory approaches. This book provides valuable insights into the economic and political thought of the early 20th century, making it essential reading for scholars and anyone interested in the history of economic policy and the role of government in regulating industries.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Budget Guide for Jail Administrators

Designed for jail administrators, this guide provides an overview of jail budget management, along with relevant responsibilities and strategies. Key aspects of jail budget management examined include: Budget implementation -- developing and using a plan to monitor expenditures; Budget management -- monitoring, managing, and controlling expenditures while garnering support; Jail revenue monitoring and management -- developing revenue plans; Performance monitoring -- establishing targets; Management through budget crisis -- factors influencing increased, decreased, or insufficient revenue; And the jail budget as a powerful administrative tool.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

How Our National Debt Can Be Paid

Explore the economic landscape of 19th-century America with William Elder's "How Our National Debt Can Be Paid." This volume, subtitled "The Wealth, Resources, And Power Of The People Of The United States," originally issued by Jay Cooke, delves into the critical issues surrounding the national debt and its potential solutions during a transformative period in American history.Elder's work offers insights into the financial strategies and economic perspectives of the time, shedding light on the challenges and opportunities facing the nation. Discover the arguments and proposals put forth to address the debt, and gain a deeper understanding of the economic forces shaping the United States. A valuable resource for historians, economists, and anyone interested in the financial history of the U.S.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Cost Forecasting Models for the Air Force Flying Hour Program

The fiscally constrained environment in which the Air Force executes its mission places great emphasis on accurate cost estimates for planning and budgeting purposes. Inaccurate estimates result in budget risks and undermine the ability of Air Force leadership to allocate resources efficiently. This thesis evaluates the current method used by the Air Force and introduces new methods to forecast future Flying Hour Program costs. The findings suggest the current forecasting method's assumption of a proportional relationship between cost and flying hours is inappropriate and the relationship is actually inelastic. Prior research has used log-linear least squares regression techniques to forecast Flying Hour Program cost, but has been limited by the occurrence of negative net costs in the underlying data. This research uses time series and panel data regression techniques while controlling for flying hours, lagged costs, and age to create net costs models and an alternative model by separately estimating the two components of net costs which are charges and credits. Finally, this research found neither the proportional, net costs, nor charge minus credit models is a superior forecaster. As such, the models introduced in this research may be used as a cross check for the current method.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Management of Energy Savings Performance Contracts

Energy Savings Performance Contracts (ESPCs) originated to accomplish several objectives: (1) to meet energy efficiency goals mandated by executive orders and energy policies; (2) to improve federal government facilities using funds allocated for utility bills; and (3) to receive repayment of expenditures through energy savings reflected in reduced utility bills. In ESPCs, the contractor guarantees savings to the federal government agency. 10 CFR 436 limits the time necessary for payback. However, this regulation and others were written prior to the deregulation of utility companies. This theory is based on the underlying premise that the contractor payback is a direct result of the energy savings. The population of study is all of the Air Force ESPCs. The sampling frame used will be the ESPCs and their task orders (TOs) listed in the Air Force Civil Engineering Support Agency (AFCESA) database. The primary unit of analysis will be the individual task order. Data will be collected from interviews, observations, conferences, archives, and other task order related documents. Using case study methodology, contract financial data, energy rates, contract decision memorandums, contract clauses and statements of work, observation, open interviews, and other relevant meetings and materials will be evaluated to determine whether deregulation has an effect on contractor payback and what the effect entails.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

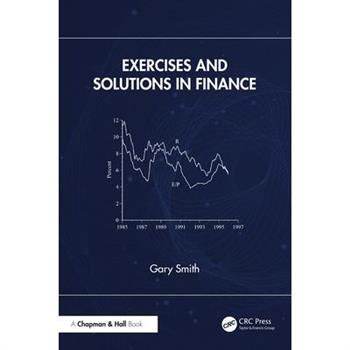

Exercises and Solutions in Finance

Hundreds of class-tested finance exercises that test student understanding. Many are educational in their own right-for example, delaying social security benefits does not give a safe 8% real return; the correlation between bond and stock returns is not stable, and most measures of company performance regress toward the mean.

An Eye for Money

Printed in color for the best reading experience.AN EYE FOR MONEY: Understanding the Three Phases of Financial Life: Setting Financial Goals, Managing Investments, and Estate Planning for Everyone offers a fresh, real-world approach to managing your financial life by organizing it into the three natural phases we all go through: building wealth (Accumulation), creating income in retirement (Income), and preserving and passing on assets (Distribution). Whether you're just starting out, preparing for retirement, or leaving a legacy, this book provides clarity and confidence to make sound financial decisions-no matter how the world changes around you.With years of experience advising individuals, families, and institutions, John Paul (JP) Phaup delivers practical guidance on investing, setting financial goals, understanding risk, and protecting assets through thoughtful estate planning. His approachable style simplifies complex concepts without watering them down, making this an accessible guide for readers at any life stage or wealth level.The book also offers valuable insights for highly compensated professionals and higher net worth individuals, covering topics like tax planning, charitable giving, and multi-generational wealth strategies.Drawing from twenty-eight years in wealth management, charitable strategy, and financial education, JP shares a grounded, practical roadmap to lasting financial well-being. If you're looking to build a secure financial future with confidence, AN EYE FOR MONEY belongs on your shelf.

Establishing a Foundation to Capture the Cost of Oversight for a Major Defense Program Within the Information Technology Acquisition Community

In 1970 the Department of Defense introduced the Department of Defense Directive 5000 to standardize the acquisition process; the directive created oversight forums to ensure the policies and procedures created were followed, track program progress, and identify programs in trouble. Although oversight was essentially created to help reduce the cost of acquisitions, there is reason to believe that it may increase the costs; however, because there has only been a few studies conducted that estimated the cost of oversight no one knows how much oversight costs individual programs. Numerous oversight processes are being used today, but no research shows one process is any different from the other. Nor have studies been done to determine the cost drivers for oversight. This thesis will provide a foundation and potential cost saving recommendations that would benefit the Department of Defense in most of the acquisition programs it monitors. An estimated cost of oversight will be calculated for programs following three different oversight processes using the Delphi Methodology. The estimates will be compared to determine if there are any statistical differences between them. A future track for the next generation of oversight processes will develop from the recommendations.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Department of Defense

In support of senior leadership emphasis on improving early systems engineering and analysis, the Enterprise Requirements and Acquisition Model(ERAM) is a quantitative discrete-event process simulation model that accounts for activities from the identification of a desired space capability early in the JCIDS process through Milestone C of the acquisition system resulting in a probabilistic schedule distribution for a given concept. This model of the DoD's space capability development process will provide valuable decision making information for Concept Characterization and Technical Descriptions referenced during Analysis of Alternatives. The research focused on identifying activities, assigning historical triangular distributions and probabilities at each decision point. Data was collected through analysis of applicable policy, instructions, and journal articles as well as interviews with subject matter experts from the Air Staff, Air Force Space Command and the Space and Missile Systems Center.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Impact of the Packard Commission's Recommendations on Reducing Cost Overruns in Major Defense Acquisitions Programs

The phenomenon of cost overruns in Department of Defense acquisitionprograms has been a problem for decades. In fact, regulations to controldefense procurements extend as far back as the 1940's. However, thesepolicies have accomplished little in controlling or reducing the problem. A 1993Rand Corporation study discussed the extent of cost growth in the DoD andindicated that cost growth has fluctuated around 20 percent since the mid 1960'sand that little improvement has occurred over time (Drezner and others, 1993:2).Other research indicates that the average cost overrun on DoD acquisitioncontracts is approximately 40 percent (Gansler, 1989:4). However onemeasures the unplanned cost increases (growth or overruns to be explainedlater in this thesis) is academic; the magnitude of the problem persists and isreadily seen as 20 to 40 percent can represent a notable loss.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Award Term Incentive Contracting

This research explored implementing a best commercial practice of establishing strategic purchasing relationships within the Department of Defense (DOD) procurement environment. The research was sparked by Air Force Material Command's (AFMC) instituting a commercial style acquisition strategy using an award term incentive on several programs. The award term incentive provides for extensions or reductions to the term of the contract based on contractors' level of performance. Forthcoming implementation of Air Force FAR supplement 5317.7X, Incentive Term Extension, will likely increase the number of acquisitions using an award term incentive. Research findings indicate that management should consider expanding the AFMC award term guidance to include the model developed from this research, which identifies decision criteria for selecting the award term incentive strategic purchasing method. Findings indicate that the acquisition professionals may not have the expertise or related purchasing skills necessary to establish strategic purchasing relationships for commercial type performance based services and that training is needed. The researcher also uncovered evidence that instability and reductions in the DOD workforce affects acquisition professionals' ability to maintain currency with the changing legal environment. Further, workforce instability and reductions may influence the implementation of strategic contractual relationships. The research concludes that implementing the award term incentive affects the DOD competitive market.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

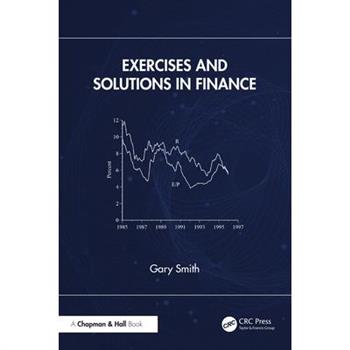

Exercises and Solutions in Finance

Hundreds of class-tested finance exercises that test student understanding. Many are educational in their own right-for example, delaying social security benefits does not give a safe 8% real return; the correlation between bond and stock returns is not stable, and most measures of company performance regress toward the mean.

Risk Analysis in Finance and Insurance

Risk Analysis in Finance and Insurance, Third Edition presents an accessible yet comprehensive introduction to the main concepts and methods that transform risk management into a quantitative science. Considering the interdisciplinary nature of risk analysis, the author discusses many important ideas from stochastic analysis, mathematical finance and actuarial science in a simplified manner. He explores the interconnections among these disciplines and encourages readers toward further study of the subject. This edition continues to study risks associated with financial and insurance contracts, using an approach that estimates the value of future payments based on current financial, insurance, and other information.Features of the third edition 12 chapters instead of 8 of the 2nd editions. Two new chapters on Wiener process as a base for financial market modeling. Option pricing in the Bachelier model, the model of Black and Scholes, the Gram-Charlier model. American options and their pricing in the Black-Scholes model Several new notions, topics and results that are not reflected yet in other textbooks, and even in monographs (Binomial model with constraints, detailed exposition of quantile hedging technique, Conditional Value at Risk, Range of Value at Risk, applications to equity-linked life insurance) Can be regarded as a self-contained issue of courses on Mathematical Finance, Actuarial Science and Risk Management Replete with new exercises, problems, hints and solutions

Coffin's Interest Tables

Coffin's Interest Tables is a comprehensive resource for calculating interest at various rates. This detailed compilation provides interest calculations for rates of one-half, one, two, three, three-and-one-half, four, four-and-one-half, five, six, seven, eight, and ten percent per annum. The tables cover amounts ranging from $1.00 to $10,000, offering a quick reference for determining interest earnings on a broad spectrum of investments and loans. This edition also includes a perennial calendar, making it a valuable tool for financial planning and historical reference. Ideal for accountants, business professionals, and anyone needing precise interest calculations, 'Coffin's Interest Tables' remains a practical and reliable guide to understanding and managing financial growth.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Financial Policy Of Corporations

The Financial Policy of Corporations, with the subtitle Corporate Securities, delves into the intricate world of corporate finance, offering a comprehensive analysis of the various securities employed by corporations to fund their operations and growth. Authored by Arthur Stone Dewing, this book explores the theoretical underpinnings and practical applications of different financial instruments, including stocks, bonds, and other forms of debt and equity. The book examines the strategic considerations that guide a corporation's financial policy, providing insights into how companies make decisions about capital structure, dividend policy, and investment strategies. It is a valuable resource for finance professionals, investors, and anyone seeking a deeper understanding of the financial mechanisms that drive the corporate world. This work offers timeless insights into the principles of sound financial management and the role of corporate securities in the broader economy.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Review Of The New Basel Capital Accord

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Amending The Revenue Act Of 1918

This volume contains the hearings before the Committee on Finance of the United States Senate during the Sixty-Sixth Congress, Second Session, regarding the proposed amendments to the 'Revenue Act of 1918'. It documents the discussions and testimonies related to H.R. 14197 and H.R. 14198, offering a detailed look into the legislative process concerning taxation during this period. Providing valuable insights into the economic considerations and policy debates of the time, this historical record is essential for researchers, economists, and anyone interested in understanding the evolution of tax law in the United States.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

A Citizen's Guide to the Federal Budget

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Defense Management

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Securitization Of Assets

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Federal Enterprise Architecture

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

IRS Offers in Compromise

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Consumer Debt

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Briefing By Representatives From The Departments And Agencies Represented On The Committee On Foreign Investment In The United States (CFIUS)

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Annual Report Of The United States Employees' Compensation Commission

This annual report from the United States Employees' Compensation Commission provides a detailed overview of the Commission's activities and performance. It offers insights into the administration of workers' compensation programs for federal employees. The report includes statistical data, case studies, and analysis of trends related to workplace injuries and compensation claims.Researchers and policymakers interested in the history of labor law, employee benefits, and government administration will find this report a valuable resource. It serves as a primary source document for understanding the evolution of workers' compensation policies in the United States.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Role Of Professional Firms In The U.S. Tax Shelter Industry

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Report Of The Vice-president Of Business And Finance

This report, compiled by the Vice-President of Business and Finance at the University of Wisconsin, offers a detailed overview of the university's financial status. It delves into budgetary matters, financial planning, and resource allocation. This document provides valuable insights into the financial operations of a major educational institution. Readers interested in higher education administration, financial management, or the specifics of university budgeting will find this report to be a crucial resource. It offers a historical snapshot and a valuable case study in institutional finance.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Reports Of The Condition Of The State Banks

"Reports Of The Condition Of The State Banks" offers a detailed examination of the financial health and regulatory compliance of state-chartered banks. Compiled by the Commissioner of Banks for North Carolina, this document provides a snapshot of the banking sector's stability and adherence to legal standards during the reporting period. These reports are crucial for understanding the economic landscape and ensuring transparency within the banking system. They offer insights into the assets, liabilities, and overall performance of individual banks, as well as the collective strength of the state's banking infrastructure. This resource is invaluable for financial analysts, economists, legal professionals, and anyone interested in the regulatory framework governing state banks.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Report Of The Vice-president Of Business And Finance

This report, compiled by the Vice-President of Business and Finance at the University of Wisconsin, offers a detailed overview of the university's financial status. It delves into budgetary matters, financial planning, and resource allocation. This document provides valuable insights into the financial operations of a major educational institution. Readers interested in higher education administration, financial management, or the specifics of university budgeting will find this report to be a crucial resource. It offers a historical snapshot and a valuable case study in institutional finance.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Private Banking

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Tax Administration

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

U.S. Department of Agriculture

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Energy Savings

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Federal Chief Information Officer

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Balance System of Savings' Bank Accounts by Double Entry