The Multipolar World

The ground has shifted under your feet - not with a single earthquake, but with thousands of small tremors. Power no longer looks like a flag on a map; it looks like multipolar world logistics, geopolitics of supply chains, and compute capacity booked months in advance. If you have wondered why headlines promise control while prices, delays, and rules say otherwise, this book gives you the missing lens.It is a field guide to global power shifts that actually matter: access to chips and cables, leverage in alliances and minilaterals, and the quiet arithmetic behind dollar dominance and sanctions. You will learn how "systems competition" works - who sets standards, who owns chokepoints, and who pays when rules change mid-voyage. Written for founders, policy professionals, investors, and curious citizens, it translates abstractions into decisions you can make on Monday morning.- See how the rise of China creates scale and friction at once- Understand why Europe's strategic autonomy is a constraint and an opportunity- Read India swing state choices as market signals, not mysteries- The spot where African demographics growth becomes real bargaining powerBy the final chapter, you will think more clearly, plan with fewer blind spots, and act with practical resilience. You will know where to add redundancy, when to hedge, and how to read the world as a stack of systems instead of a tug-of-war between empires. In a century with many centres, clarity is the rarest advantage.

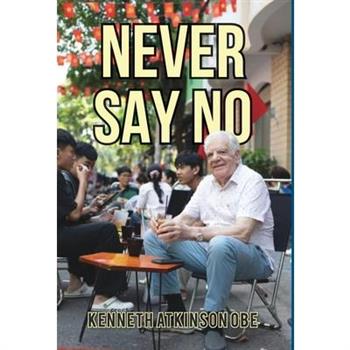

Never Say No

Ken Atkinson's business career began with selling ice cream in a northern English town. Humble beginnings, yes, but a hint at the entrepreneurial spirit and ambition that would soon define his life. What began as a modest venture soon took root in the world of international banking and eventually grew into a long-term role in nurturing Vietnam's economy and strengthening its ties with the global markets. Navigating foreign shores, socially and economically, he found his way into even the most formidable and complex markets, including the opening up of both Russia and China to foreign invested projects. This memoir is filled with expert economic insights and tales of risk, reward, and resilience. Entertaining as it is intelligent, it offers a first-hand account of how emerging Asian markets were transformed. For the past three decades, Ken has lived, worked and found a home in Vietnam, with Ho Chi Minh City as his base. Along the way, there have been many ups and downs, moments of suspense and humour, and it is all documented in this magnificent and unique memoir. Not bad for a kid who grew up amid the fields and stonewalls of northern England. From Saddleworth to Saigon, Ken's story is sure to inspire anyone with an ounce of ambition to pursue greatness and to never say no to opportunity.

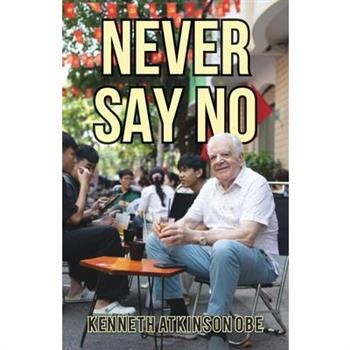

Never Say No

Ken Atkinson's business career began with selling ice cream in a northern English town. Humble beginnings, yes, but a hint at the entrepreneurial spirit and ambition that would soon define his life. What began as a modest venture soon took root in the world of international banking and eventually grew into a long-term role in nurturing Vietnam's economy and strengthening its ties with the global markets. Navigating foreign shores, socially and economically, he found his way into even the most formidable and complex markets, including the opening up of both Russia and China to foreign invested projects. This memoir is filled with expert economic insights and tales of risk, reward, and resilience. Entertaining as it is intelligent, it offers a first-hand account of how emerging Asian markets were transformed. For the past three decades, Ken has lived, worked and found a home in Vietnam, with Ho Chi Minh City as his base. Along the way, there have been many ups and downs, moments of suspense and humour, and it is all documented in this magnificent and unique memoir. Not bad for a kid who grew up amid the fields and stonewalls of northern England. From Saddleworth to Saigon, Ken's story is sure to inspire anyone with an ounce of ambition to pursue greatness and to never say no to opportunity.

BRICS and All That

Five countries hop on a group chat...BRICS is an international development organization founded in 2009 by its namesake charter members: Brazil, Russia, India, China and South Africa. These countries wanted to create an international trading and monetary system to counter the dollar-denominated global economy dominated by the United States and its European and Asian allies. BRICS AND ALL THAT offers a humorous account-held together by a sturdy thread of fact-of the events and personalities that have shaped the development of the BRICS organization over the past two decades. This book gently immerses the reader in the language of international finance using a mix of light-hearted vignettes and narratives. BRICS AND ALL THAT provides unconventional histories of the two grouchy countries-China and Russia-who have been at the forefront of efforts to end the U.S. dollar's role as the global reserve currency. It also shows how development loans are underwritten by the organization's New Development Bank-which was originally envisioned by the BRICS founders as a potential challenger to the IMF and the World Bank. BRICS AND ALL THAT gives a summary of the pros and cons of BRICS-highlighting both its successes and its failures during its first two decades. Dead economists ranging from Adam Smith and David Ricardo to John Maynard Keynes and Milton Friedman have not refused to embrace BRICS AND ALL THAT as a worthy successor to Adam Smith's Wealth of Nations. Yet Smith's seminal, albeit dated, masterwork-unlike BRICS AND ALL THAT-offers little information about such weighty topics as reserve currencies and the loan underwriting processes for large-scale projects such as hydroelectric dams. This book is not endorsed by any heads of state.Jefferson Hane Weaver's previous work with Armin Lear Press is ECONOMICS AND ALL THAT, a humorous-and factual-explanation of key topics in economics. He is also the author of numerous books including WHAT ARE THE ODDS? He received his undergraduate degree in Economics and Politi-cal Science from the University of North Carolina at Chapel Hill. He also received his J.D. and his Ph.D. from Columbia University.

Managing Human Capital During the Covid-19 Pandemic

This book offers a critical, reflective and contextual analysis on human capital and how it was managed globally during the COVID-19 pandemic. It covers macro, meso and micro perspectives, identifies gaps in our existing knowledge and offers implications for the study and practice of global human capital management, post the COVID-19 pandemic. Evidence from the studies in our book suggest that organizations globally employ a mixed workforce, consisting of individuals from various nationalities and cultures. While this brings undoubted opportunity for both employees and firms, one of the challenges in promoting long term growth and global competitiveness, specifically during a global crisis, is how effectively human capital is managed in a professional but humane manner, such that it enhances overall employee engagement and long-term commitment. Overall, this contribution complements the other titles in the Palgrave Studies in Global Human Capital Management series.

Governance Challenges in the State of Yemen

The concept of governance has gained greater attention from scholars and international organizations as a foundation for growth, particularly to lift developing countries from dire situations and bring more prosperity to the developed world. However, according to the World Bank, Yemen is considered one of the most poorly governed countries in the world. This poor evaluation motivated this study into the challenges to good governance in Yemen and the author's desire to demonstrate the importance of governance in addressing Yemen's current critical situation. Despite the extensive literature published on governance, works on Yemen are rare, and there is barely any academic work on governance challenges. This relatively small body of literature encouraged me to examine in depth the obstacles to governance in Yemen. This study builds a theoretical framework to examine the difficulties of establishing good governance in Yemen by exploring the critical social and institutional challenges vital for good governance. This dissertation poses the following question: What are the challenges to good governance in Yemen, and why and how do they hamper good governance in Yemen? To address this research question, I adopted a qualitative interpretive approach. This analysis is based on information gathered from a variety of sources, including mainly semi-structured formal and informal interviews, observations, governance and government materials, such as international reports, governance manuals, websites, social media posts, and related videos, among others. The findings expose nine dimensions and 21 constructed themes, which scrutinize how and why governance is hampered in Yemen. Overall, this study introduces numbers of contributions to the governance literature by identifying social and institutional challenges and showing how they influence good governance and state-building in the Yemen context. More specifically, this Ph.D. contributes to identifying and discussing the issues

Environmental Sustainability, Innovations for Emerging Markets and Marketing in Emerging Markets

Environmental Sustainability, Innovations for Emerging Markets, and Marketing in Emerging Markets by Rajan Vardarajan is a comprehensive guide to understanding the intricate relationship between sustainability, innovation, and marketing in developing economies. The book explores how businesses can adopt environmentally sustainable practices while driving innovation to meet the unique challenges of emerging markets. Vardarajan highlights the importance of integrating green technologies and sustainable strategies into marketing practices to cater to the evolving demands of these rapidly growing regions. Through case studies and expert insights, the book emphasizes how companies can leverage environmental sustainability to enhance brand reputation, attract customers, and stay competitive in emerging markets. Ideal for business professionals, marketers, and academics, this work provides valuable frameworks for navigating the complexities of sustainable marketing in emerging economies. It serves as an essential resource for anyone seeking to build sustainable, innovative strategies in the context of developing markets.

Environmental Sustainability, Innovations for Emerging Markets and Marketing in Emerging Markets

Environmental Sustainability, Innovations for Emerging Markets, and Marketing in Emerging Markets by Rajan Vardarajan is a comprehensive guide to understanding the intricate relationship between sustainability, innovation, and marketing in developing economies. The book explores how businesses can adopt environmentally sustainable practices while driving innovation to meet the unique challenges of emerging markets. Vardarajan highlights the importance of integrating green technologies and sustainable strategies into marketing practices to cater to the evolving demands of these rapidly growing regions. Through case studies and expert insights, the book emphasizes how companies can leverage environmental sustainability to enhance brand reputation, attract customers, and stay competitive in emerging markets. Ideal for business professionals, marketers, and academics, this work provides valuable frameworks for navigating the complexities of sustainable marketing in emerging economies. It serves as an essential resource for anyone seeking to build sustainable, innovative strategies in the context of developing markets.

Global Business

This textbook is designed to help students recognize and analyze key issues in global business by bridging theory with real-world applications. Divided into three parts, it explores critical aspects of global business, introducing readers to relevant topics and examining core concepts and their applications through about 40 case studies.Since the first edition was published in 2017, the global business landscape has undergone profound transformations, reshaping how companies operate, compete, and innovate. This new edition incorporates critical developments in the aftermath of the COVID-19 pandemic to provide leaders with a comprehensive understanding of today's global business environment.New and updated case studies illustrate the magnitude and complexity of global business, highlighting the roles of various stakeholders. In addition to insights on emerging markets, this edition sheds new light on reglobalization, economic nationalism and geopolitical tensions, technological innovation and digital transformation, and sustainability, enabling readers to stay informed about ever-evolving trends. By demonstrating how theories and concepts work in real-world business settings, this book provides readers with the essential tools to analyze and respond to global business challenges effectively. Undergraduate students looking for an introduction to international business and graduate students looking to apply their knowledge will find Global Business stimulating, as it demonstrates how theories and concepts work in realworld business settings.

The Protective Question Abroad...

"The Protective Question Abroad... And Miscellaneous Pamphlets On Free Trade and Protection" by John Lord Hayes presents a collection of essays and pamphlets exploring the economic debate between free trade and protectionism. This volume delves into the arguments surrounding tariffs, international trade, and the impact of protectionist policies on various nations. Hayes offers a detailed examination of the protective question, advocating for specific economic strategies and analyzing their potential effects. This work provides valuable insights into 19th-century economic thought and policy. It remains relevant for understanding the historical context of trade debates and the enduring questions surrounding economic protectionism. Scholars and readers interested in the history of economic policy and the ongoing discussions about free trade will find this collection a compelling resource.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Questioning the International Role of the Dollar

Essay from the year 2025 in the subject Economics - International Economic Relations, language: English, abstract: World War I significantly contributed to the rise of the US dollar as a key global currency. Before the war, the British pound sterling was the dominant international currency, serving as the main reserve currency and medium of exchange worldwide. However, the devastation caused by WWI led to economic instability in Europe, especially in Britain and France, which reduced confidence in their currencies. Meanwhile, the US economy experienced rapid growth during the war, becoming a major lender and supplier of goods to wartime allies in Europe. This shift increased global reliance on the US dollar as countries and investors held more reserves in dollars due to the size and stability of the US economy, and its dynamic financial markets. Although the London Monetary and Economic Conference of 1933 impacted negatively on the dollar strength, the Bretton Woods Agreement of 1944 officially established the US dollar as the world's primary reserve currency, linked to gold. This privileged status of the dollar endowed the United States with quite unique economic advantages-such as the ability to borrow cheaply, repay its international debts with its own currency and exert outsized influence on international finance and geopolitics. Yet the dollar's supremacy has never gone unchallenged. For nearly a century, policymakers, economists, and political leaders across the world have questioned the sustainability and fairness of a system so heavily reliant on one nation's currency. This book traces that long and complex story, from the early visionary ideas of John Maynard Keynes in the 1930s, through the postwar Bretton Woods system and the related Triffin's Dilemma, to contemporary challenges posed by regional currencies, such as the euro, digital innovations, like for instance the bitcoin, and emerging economic powers - in particular the enlarging BRICS.

Political Risk and the Politics of Risk

This book provides a critical analysis of how credit rating agencies engage with the political and economic dynamics of developing countries. Focusing on Brazil and Argentina, it demonstrates how S&P Global, Moody's Investor Service, and Fitch Ratings--the "Big Three"--employ a politics of risk that seeks to advance the interests of global financial markets while interacting with domestic governance processes. Drawing on underexplored materials such as sovereign rating reports and press releases, this book examines how these agencies deploy their evaluations and public statements as instruments of this politics of risk. Their actions respond to the political risk conditions they identify, which are shaped by factors such as government ideology and shifts in the international context. Through detailed case studies of Brazil and Argentina, this book shows how credit rating agencies become part of wider political disputes over economic policy and governance in the Global South. Bringing together key debates in International Political Economy, "Political Risk and the Politics of Risk" sheds light on the intersections of financialization, neoliberalism, and the tensions between financial globalization and democratic governance. By revisiting recent political and economic developments in two of Latin America's largest economies, this book fills a crucial gap in the literature and offers fresh insights into the often-overlooked role of credit rating agencies in contemporary global capitalism. This book will be of interest to scholars, students, and practitioners in International Political Economy, Political Science, Development Studies, and Latin American studies, as well as those seeking to understand the complex relationships between finance, politics, and power in emerging economies.

The Chinese Global Dream, Volume II

This book explores the socio-economic, political and diplomatic implications of China's ongoing engagement with the Latin America region against the backdrop of an increasingly fragile global political climate. It investigates the successes of the post-pandemic era diplomacy, alongside the setbacks, as China seeks to secure and maintain her presence across the region. Ever since Xi lengthened his stewardship of China by another decade, he has been aiming to level-up the Chinese values and Sino-orientalism on the global stage. Through the Belt and Road Initiative (BRI) he expanded into the Middle East, and through natural resource veiled humanitarian relief efforts, he sought to strengthen China's hold across Africa. Only Latin America now remains. This book investigates the tentative shift in bilateral and multilateral relations, along with the possibility and likelihood of a stronger China-Latin America alliance, and the reactions of the West. The book endeavours to combine traditional academic discourse with contemporary interpretations and provides a balanced assessment of the current successes and drawbacks of the network. Making a comparative analysis of the roles of each of the Latin American nations in allowing China to fulfil this endeavour through a global vs. local approach, this book is suitable for those researching and studying contemporary Chinese strategic relations, regional studies and geo-strategy.

Catholic Social Teaching and the Development of Nations

This book addresses Catholic Social Teaching's questions. First, what the Church teaches about the economic development of nations; second, how these teachings can be applied to the case of the DRC; third, how this application works. The Church teaches about economic development through moral principles of the universal destination of goods and solidarity. With regard to the universal destination of goods, the Church teaches that all the goods of the earth, especially the new goods, which are technological and scientific knowledge, have to be shared fairly with all nations (Compendium of the Social Doctrine of the Church, 179). With solidarity, the Church suggests international cooperation among nations for development (Compendium, 446). These teachings can be applied to the case of the DRC, which is a poor country in need of technological knowledge to develop its natural resources to encourage economic and integral development. Education could make this project happen. Some professors from Catholic University of America and the University of Notre Dame can volunteer to teach technological knowledge at the Catholic University of Congo; they can also offer scholarships to students.

Argentina's Sovereign Debt Restructuring

In December 2001, after four years of deepening recession and mounting social unrest, Argentina's government collapsed and ceased all debt payments. Argentina has failed to pay before, but this time it registered the largest sovereign default in history. Argentina must restructure over $100 billion owed to domestic and foreign bondholders, including $10 billion held by U.S. investors. A final offer made in June 2004 amounted to a 75% reduction in the net present value of this debt, and although an improved offer is expected by year-end, it is still the largest proposed write-down in the history of sovereign restructurings, which foreign bondholders have rejected.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Review of Foreign Developments

The Review of Foreign Developments (RFD) series begins in 1945 and ends in 1975. Starting in August 1971, papers in the RFD series also appear in the International Finance Discussion Paper (IFDP) series. These topics are focused on, though by no means limited to, international macroeconomics, international trade, global finance, financial institutions, and markets, as well as international capital flows. The analyses and conclusions set forth in the RFD series are those of the authors and do not indicate concurrence by other members of the research staff or the Board of Governors.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Armenian Merchants of the Seventeenth and Early Eighteenth Centuries

This is a print on demand publication. Tells a fascinating story about the trade relationship between the English East India Co. and the powerful Armenian merchant community of New Julfa that lasted over 100 years (17th and early 18th cent.). This relationship revolved around the Co's. continual efforts to break into the Armenian held silk and cloth markets. This trade relationship epitomizes the age of competitive partnership that existed then. Addresses the question "What was the key to the Armenian merchants' success during the pre-modern period?". Their "fabulous success" may be attributed to the rare atmosphere of trust that prevailed among the Armenian merchant community which, in turn, led to two significant benefits: organizational cost savings; and organizational innovations.

Transfer Pricing, Intrafirm Trade and the BLS International Price Program

Most governments keep balance of payments statistics on exports and imports by value, and construct international price indexes in order to deflate these statistics. How can intrafirm trades, trade between related parties, bias the construction of these international price indexes? Does transfer pricing, the price of products traded between related party firms, bias the export and import price indexes in any predictable fashion? If firms manipulate transfer prices to avoid taxes or tariffs, what is the appropriate transfer price to use in constructing export and import price indexes, in theory and in practice? These issues are important because related party trade is large, representing half of U.S. imports and one-third of U.S. exports, and perhaps a third of worldwide merchandise trade flows. This paper explains how transfer pricing and intrafirm trade can bias the construction of export and import price indexes, outlines and evaluates the various prices that could be used to construct these indexes, and makes some recommendations for the international price program run by the U.S. Bureau of Labor Statistics.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

International Finance Discussion Papers

This paper analyzes the implications of remittance fluctuations for various macroeconomic variables and Sudden Stops. The paper employs a quantitative two-sector model of a small open economy with financial frictions calibrated to Mexican and Turkish economies, two major recipients, whose remittance receipts feature opposite cyclical characteristics. We find that remittances dampen the business cycles in Mexico, whereas they amplify the cycles in Turkey. Their quantitative effects in the long run, approximated by the stochastic steady state are mild. In the short run, however, remittances have quantitatively large impacts on the economy, when the economy is borrowing constrained. This is because agents in the economy cannot adjust their precautionary wealth to sudden tightening in credit, hence, fluctuations in remittances get magnified through an endogenous debt-deflation mechanism. Our findings suggest that procyclical (or countercyclical) remittances can play a significant deepening (or mitigating) role for Sudden Stops.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

International Finance Discussion Papers

This paper asks whether an aggressive monetary policy response to inflation is feasible in countries that suffer from fiscal dominance, as long as monetary policy also responds to fiscal variables. We find that if nominal interest rates are allowed to respond to government debt, even aggressive rules that satisfy the Taylor principle can produce unique equilibria. But following such rules results in extremely volatile inflation. This leads to very frequent violations of the zero lower bound on nominal interest rates that make such rules infeasible. Even within the set of feasible rules the optimal response to inflation is highly negative, and more aggressive inflation fighting is inferior from a welfare point of view. The welfare gain from responding to fiscal variables is minimal compared to the gain from eliminating fiscal dominance.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Review of Foreign Developments

The Review of Foreign Developments (RFD) series begins in 1945 and ends in 1975. Starting in August 1971, papers in the RFD series also appear in the International Finance Discussion Paper (IFDP) series. These topics are focused on, though by no means limited to, international macroeconomics, international trade, global finance, financial institutions, and markets, as well as international capital flows. The analyses and conclusions set forth in the RFD series are those of the authors and do not indicate concurrence by other members of the research staff or the Board of Governors.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

International Finance Discussion Papers

We seek to understand how Laffer curves differ across countries in the US and the EU-14, thereby providing insights into fiscal limits for government spending and the service of sovereign debt. As an application, we analyze the consequences for the permanent sustainability of current debt levels, when interest rates are permanently increased e.g. due to default fears. We build on the analysis in Trabandt and Uhlig (2011) and extend it in several ways. To obtain a better fit to the data, we allow for monopolistic competition as well as partial taxation of pure profit income. We update the sample to 2010, thereby including recent increases in government spending and their fiscal consequences. We provide new tax rate data. We conduct an analysis for the pessimistic case that the recent fiscal shifts are permanent. We include a cross-country analysis on consumption taxes as well as a more detailed investigation of the inclusion of human capital considerations for labor taxation.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

International Finance Discussion Papers

This paper analyzes the implications of remittance fluctuations for various macroeconomic variables and Sudden Stops. The paper employs a quantitative two-sector model of a small open economy with financial frictions calibrated to Mexican and Turkish economies, two major recipients, whose remittance receipts feature opposite cyclical characteristics. We find that remittances dampen the business cycles in Mexico, whereas they amplify the cycles in Turkey. Their quantitative effects in the long run, approximated by the stochastic steady state are mild. In the short run, however, remittances have quantitatively large impacts on the economy, when the economy is borrowing constrained. This is because agents in the economy cannot adjust their precautionary wealth to sudden tightening in credit, hence, fluctuations in remittances get magnified through an endogenous debt-deflation mechanism. Our findings suggest that procyclical (or countercyclical) remittances can play a significant deepening (or mitigating) role for Sudden Stops.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

International Finance Discussion Papers

Understanding the joint dynamics of international prices and quantities remains a central issue in international business cycles. International relative prices appreciate when domestic consumption and output increase more than their foreign counterparts. In addition, both trade flows and trade prices display sizable volatility. This paper incorporates Hicks-neutral and investment-specific technology shocks into a standard two-country general equilibrium model with variable capacity utilization and weak wealth effects on labor supply. Investment-specific technology shocks introduce a source of fluctuations in absorption similar to taste shocks, thus reconciling theory and data. The paper also presents implications for the transmission mechanism of technology shocks across countries and for the Barro and King (1984) critique of investment shocks.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Transfer Pricing, Intrafirm Trade and the BLS International Price Program

Most governments keep balance of payments statistics on exports and imports by value, and construct international price indexes in order to deflate these statistics. How can intrafirm trades, trade between related parties, bias the construction of these international price indexes? Does transfer pricing, the price of products traded between related party firms, bias the export and import price indexes in any predictable fashion? If firms manipulate transfer prices to avoid taxes or tariffs, what is the appropriate transfer price to use in constructing export and import price indexes, in theory and in practice? These issues are important because related party trade is large, representing half of U.S. imports and one-third of U.S. exports, and perhaps a third of worldwide merchandise trade flows. This paper explains how transfer pricing and intrafirm trade can bias the construction of export and import price indexes, outlines and evaluates the various prices that could be used to construct these indexes, and makes some recommendations for the international price program run by the U.S. Bureau of Labor Statistics.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Free Trade in the Americas

Increasingly, America's security objectives are defined by U.S. economic interests. In Latin America, closed economies and authoritarian governments are transitioning to market-oriented systems and democratic institutions, resulting in increased goodwill and cooperation between the U.S. and Latin America. In 1993, President Clinton pushed hard and won congressional approval on the North American Free Trade Agreement (NAFTA) between the U.S., Canada, and Mexico. Along with this, he orchestrated the landmark Summit of the Americas in December 1994 between the U.S., Canada, and the democratically-elected leaders of Latin America and the Caribbean. The result of the "Miami Summit" was a proclamation that the nations of the Western Hemisphere would establish a hemispheric free trade area with a target date of 2005. However, in 1994 and 1995, the peso crisis, brought on by a series of problems within Mexico, caused that country's financial system to collapse along with the hopes for a hemispheric free trade pact in the near future.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Between East and West

Up to & including the Age of Discoveries, the wealth of the East was thought in Europe to consist primarily of spices & aromatics. Cloves, nutmeg, mace, & sandalwood all were thought to come from a few small islands in easternmost Indonesia, which no European reached before 1500. Yet supplies of these luxury products were reaching China, India, western Asia, & the Mediterranean lands more than a thousand years earlier. This study of Moluccan spices opens with their natural history & nomenclature, & the discovery of the Islands by Europeans near the opposing (& controversial) limits of Spanish & Portuguese jurisdiction. Donkin traces the expanding interest & long-distance trade in cloves, nutmeg, & sandalwood, first to India & then to the adjacent Arabo-Persian world. The medieval West & China lay on the margins of diffusion, the former in touch with the Levant, the latter with the trading world of South East Asia.

Applied Economics in Globalised Economies

Globalisation, the increasing integration of markets and ideas across borders throughout the world, has redefined how economies function, how societies interact, and how nations confront shared challenges. Recognising these profound transformations, this book attempts to bridge the divide between economics and economies as well as the gap between theories and policies. Complete with case studies, lecture slides, test questions, and sample data/codes, the book is an engaging resource for upper undergraduates and postgraduate economics students alike.

Handbook of Development Economics

Development Economics applies modern techniques of macroeconomic and microeconomic analysis to the study of the economic, social, environmental and institutional problems facing developing countries. It focuses on the determinants of poverty and underdevelopment, as well as on the policies that need to be implemented in order to improve the development of developing countries. As a set of public and private practices that support economic growth, development economics appears in its generality as a transversal knowledge, because it guides the participation of all actors in the development effort. The aim of this book is to explain the principles of development economics, and to identify the ways in which economic problems can be tackled. It is divided into three main sections.The first part introduces the major framers of the world economy; the second offers the essential concepts and principles of macroeconomics; and the third elucidates the major issues in international economics.

Dollar's Vulnerability and the Implications for National Security

The United States enjoys a significant benefit from the dollar's status as the predominant international currency. These financial benefits translate into increased state power through autonomy and the ability to shape the rules of the international system. In exchange, the rest of the world benefits from having a relatively safe and liquid investment for its capital and reduced transaction costs for international trade. Because of the benefits to state power, ensuring that the dollar remains the leading international currency is a national security issue for the United States. Based on economic theory and an analysis of the last transition of leading international currencies between the sterling and the dollar, there are emerging vulnerabilities that threaten the dollar's status. Many are long-term issues that do not present an immediate threat to national security; however, increasing reliance on foreign sources to finance United States debt has created a potentially dangerous situation. Analysis of some of the major holders of United States Treasury Securities shows that the nations that are financing United States deficit spending face significant economic issues of their own. A crisis in those nations could result in a run on the dollar, which could temporarily paralyze the United States Government, and poses long term implications to national security as the nation loses its relatively inexpensive source of foreign finance.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Public Hearings In The Philippine Islands Upon The Proposed Reduction Of The Tariff Upon Philippine Sugar And Tobacco, The Extension Of The United States Coastwise Navigation Laws To The Philippines,

This volume contains the proceedings of public hearings held in the Philippine Islands concerning proposed economic legislation. The hearings focus on the potential reduction of tariffs on Philippine sugar and tobacco, the extension of United States coastwise navigation laws to the Philippines, and a broad examination of the general economic conditions prevailing in the islands during the period. The discussions offer a detailed snapshot of the economic and political considerations at play in the relationship between the United States and the Philippines during the early 20th century. The testimony and debates reflect diverse perspectives on the potential impacts of the proposed policies, providing invaluable insights for researchers and historians interested in the economic history of the Philippines and the dynamics of colonial administration. The publication serves as a primary source for understanding the complex interplay of trade, law, and governance in a colonial context.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Sovereign Wealth Fund Acquisitions And Other Foreign Government Investments In The U.S.

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Report On Cooperation In American Export Trade

This is "Report On Cooperation In American Export Trade," Volume 1, published June 30, 1916, by the United States Federal Trade Commission. This historical document offers insights into the state of American export trade at the beginning of the 20th century. It provides a detailed look into the cooperative practices and strategies employed by businesses to compete in the international market. As a report from the Federal Trade Commission, it carries significant weight as an official record of the economic landscape of the time.The book is valuable for historians, economists, and business scholars interested in understanding the evolution of American trade policies and practices. Its detailed analysis makes it a relevant resource for those studying the historical context of international business and governmental influence on trade.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The American Protectionist's Manual

The American Protectionist's Manual, by Giles Badger Stebbins, presents a robust argument for protectionist economic policies in the United States. Stebbins contends that protecting domestic industries is essential for national independence and the well-being of the American people. He argues that British free trade policies are a delusion and a peril to American prosperity. This book offers a detailed examination of the economic theories and historical context surrounding the protectionism debate in the 19th century. Stebbins makes a case for tariffs and other measures designed to shield American businesses from foreign competition. This work provides valuable insights into the economic philosophies that shaped American policy during a crucial period of industrial development.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

China In The Wto

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Economic Impacts Of The Canadian Softwood Lumber Dispute On U.S. Industries

The BiblioGov Project is an effort to expand awareness of the public documents and records of the U.S. Government via print publications. In broadening the public understanding of government and its work, an enlightened democracy can grow and prosper. Ranging from historic Congressional Bills to the most recent Budget of the United States Government, the BiblioGov Project spans a wealth of government information. These works are now made available through an environmentally friendly, print-on-demand basis, using only what is necessary to meet the required demands of an interested public. We invite you to learn of the records of the U.S. Government, heightening the knowledge and debate that can lead from such publications.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Primary Sources, Historical Collections

"The Future of Exchange and the Indian Currency" by Herbert Stanley Jevons, with a foreword by T.S. Wentworth, offers a detailed examination of Indian currency and exchange dynamics during a critical period. This primary source provides valuable insights into the economic considerations and policy debates surrounding the Indian monetary system. Jevons explores the factors influencing exchange rates and their implications for trade and financial stability. This historical collection is essential for economists, historians, and anyone interested in understanding the complexities of currency management and international finance. The inclusion of T.S. Wentworth's foreword adds further context and perspective to the analysis, making it a significant contribution to the literature on economic history.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The Protective Question Abroad...

"The Protective Question Abroad... And Miscellaneous Pamphlets On Free Trade and Protection" by John Lord Hayes presents a collection of essays and pamphlets exploring the economic debate between free trade and protectionism. This volume delves into the arguments surrounding tariffs, international trade, and the impact of protectionist policies on various nations. Hayes offers a detailed examination of the protective question, advocating for specific economic strategies and analyzing their potential effects. This work provides valuable insights into 19th-century economic thought and policy. It remains relevant for understanding the historical context of trade debates and the enduring questions surrounding economic protectionism. Scholars and readers interested in the history of economic policy and the ongoing discussions about free trade will find this collection a compelling resource.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Public Hearings In The Philippine Islands Upon The Proposed Reduction Of The Tariff Upon Philippine Sugar And Tobacco, The Extension Of The United States Coastwise Navigation Laws To The Philippines,

This volume contains the proceedings of public hearings held in the Philippine Islands concerning proposed economic legislation. The hearings focus on the potential reduction of tariffs on Philippine sugar and tobacco, the extension of United States coastwise navigation laws to the Philippines, and a broad examination of the general economic conditions prevailing in the islands during the period. The discussions offer a detailed snapshot of the economic and political considerations at play in the relationship between the United States and the Philippines during the early 20th century. The testimony and debates reflect diverse perspectives on the potential impacts of the proposed policies, providing invaluable insights for researchers and historians interested in the economic history of the Philippines and the dynamics of colonial administration. The publication serves as a primary source for understanding the complex interplay of trade, law, and governance in a colonial context.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Report On Cooperation In American Export Trade

This is "Report On Cooperation In American Export Trade," Volume 1, published June 30, 1916, by the United States Federal Trade Commission. This historical document offers insights into the state of American export trade at the beginning of the 20th century. It provides a detailed look into the cooperative practices and strategies employed by businesses to compete in the international market. As a report from the Federal Trade Commission, it carries significant weight as an official record of the economic landscape of the time.The book is valuable for historians, economists, and business scholars interested in understanding the evolution of American trade policies and practices. Its detailed analysis makes it a relevant resource for those studying the historical context of international business and governmental influence on trade.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Letters ... To The Chairman Of The ... East India Company, Upon An Open Trade To India

Letters ... To The Chairman Of The ... East India Company, Upon An Open Trade To India presents a historical perspective on the debates surrounding trade policies with India during the era of the East India Company. Authored by Henry Dundas, 1st Viscount Melville, these letters offer insights into the economic and political considerations of the time. Dundas, a prominent figure in British politics, articulates arguments concerning the benefits of an open trading system and critiques the existing monopolistic practices of the Company. This volume provides valuable primary source material for scholars and enthusiasts interested in the history of British colonialism, international trade, and the economic development of India. It sheds light on the complexities of governance, commercial interests, and policy-making that shaped the relationship between Britain and India during a critical period of imperial expansion. The letters offer a nuanced understanding of the era's challenges and opportunities, making it a significant contribution to historical literature.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Chinese Eggs

"Chinese Eggs: Conditions Of Egg Production In China And Competition In Pacific Coast Markets, Prices, Imports, Exports" delves into the intricacies of egg production in early 20th-century China and its impact on international trade. Authored by James Frederic Thorne and the University of Oregon's School of Commerce, this study provides a detailed analysis of the economic conditions surrounding egg farming in China. It examines the competitive landscape within Pacific Coast markets, focusing on price fluctuations, import/export dynamics, and the broader implications for commercial and industrial service. This historical account offers valuable insights into the global agricultural economy and the challenges of international trade in a specific commodity.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

Letters ... To The Chairman Of The ... East India Company, Upon An Open Trade To India

Letters ... To The Chairman Of The ... East India Company, Upon An Open Trade To India presents a historical perspective on the debates surrounding trade policies with India during the era of the East India Company. Authored by Henry Dundas, 1st Viscount Melville, these letters offer insights into the economic and political considerations of the time. Dundas, a prominent figure in British politics, articulates arguments concerning the benefits of an open trading system and critiques the existing monopolistic practices of the Company. This volume provides valuable primary source material for scholars and enthusiasts interested in the history of British colonialism, international trade, and the economic development of India. It sheds light on the complexities of governance, commercial interests, and policy-making that shaped the relationship between Britain and India during a critical period of imperial expansion. The letters offer a nuanced understanding of the era's challenges and opportunities, making it a significant contribution to historical literature.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

A Simple Theory of Multinational Corporations and Trade With a Trade-off Between Proximity and Concentration

"A Simple Theory of Multinational Corporations and Trade With a Trade-off Between Proximity and Concentration" presents an economic model analyzing the strategic decisions of multinational corporations in the context of international trade. Authored by Lael Brainard of the Sloan School of Management, this study explores the balance between locating production near consumers (proximity) and concentrating production in fewer locations to exploit economies of scale. The work provides valuable insights into the factors driving foreign direct investment and the structure of global production networks. It remains relevant for economists and business strategists interested in understanding the complex dynamics of multinational enterprises and their impact on international trade patterns.This work has been selected by scholars as being culturally important, and is part of the knowledge base of civilization as we know it. This work was reproduced from the original artifact, and remains as true to the original work as possible. Therefore, you will see the original copyright references, library stamps (as most of these works have been housed in our most important libraries around the world), and other notations in the work.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.As a reproduction of a historical artifact, this work may contain missing or blurred pages, poor pictures, errant marks, etc. Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.

The American Protectionist's Manual